Welcome to the Weekly Market Update!

In this edition, we bring you the latest highlights and insights from the world of finance. We will cover the week’s top stories, provide market analysis, highlight economic developments, discuss upcoming events to watch, and present technical analysis. Let’s delve into the key information you need to stay informed and make informed financial decisions.

Top Stories of the Week

- Meta Unveils Quest 3: The $500 headset shifts focus from VR to mixed reality, extending potential usage.

- Tesla Drops Amid EU Investigation: The company faces scrutiny in an EU probe into Chinese EV subsidies.

- Evergrande Shares Frozen: Chinese authorities investigate the firm’s mainland unit, halting debt reissuance.

- Micron Slips Post-Earnings: Despite beating estimates, the chipmaker offers a lukewarm outlook for the current quarter.

- US Nears Federal Shutdown: Budget disputes risk causing the 14th government shutdown since 1981.

Market Analysis

- Oil Prices Surge to 2023 Highs: Brent crude futures closed at $96.55, nearly touching $97 during the session, while WTI crude soared to $93.68. A significant 2.2 million-barrel drop in U.S. crude stockpiles, far exceeding the expected 320,000-barrel decline, fueled concerns over tightening global supplies. Cushing storage levels fell to their lowest since July 2022, nearing minimum operational inventories. The rally follows OPEC+ production cuts of 1.3 million barrels per day until year-end. Adding to supply worries, Russia aims to stabilize domestic fuel prices, potentially restricting exports.

Economic Highlights

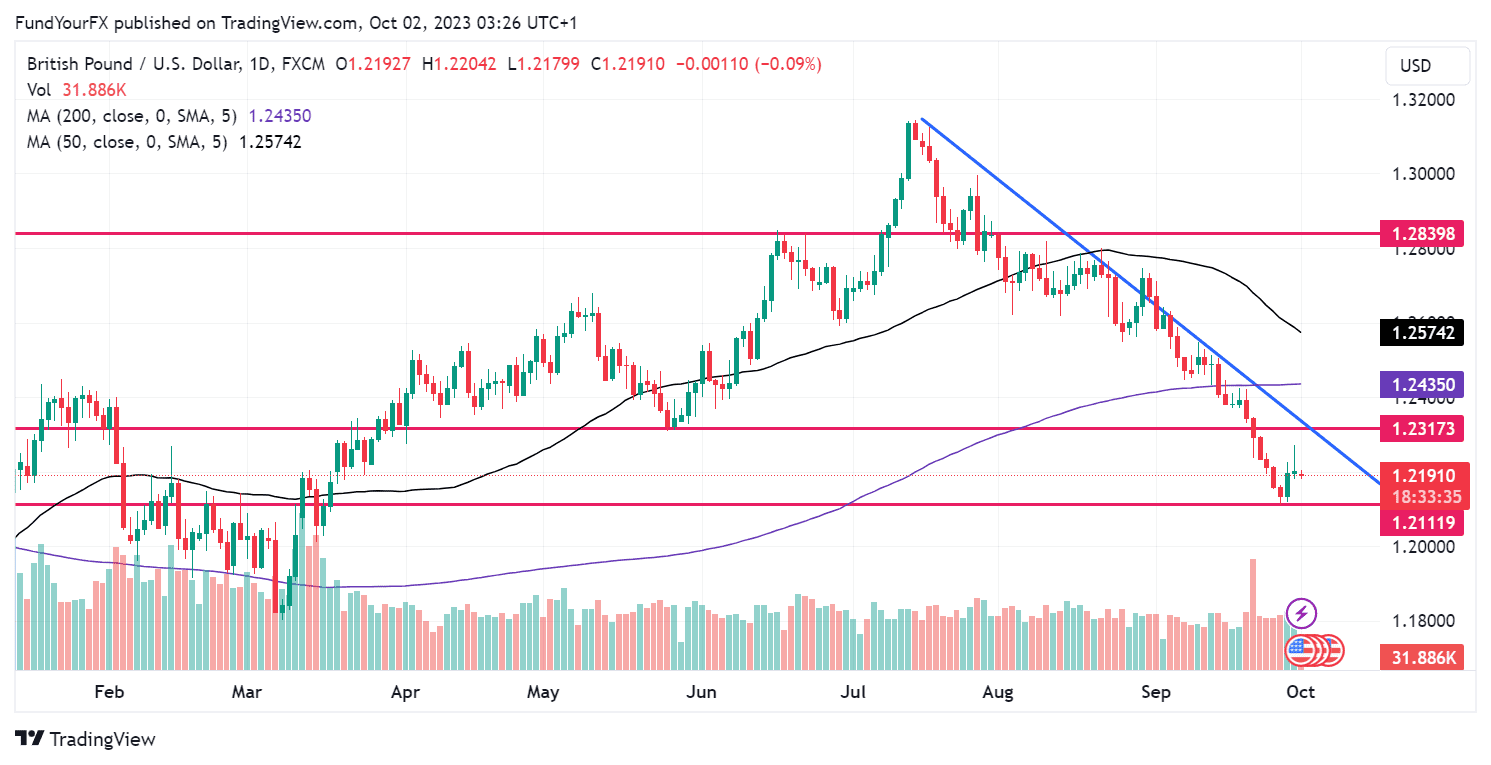

- Sterling Hits Six-Month Low, BoE Rate Hikes in Doubt: The British pound fell to a new six-month low against the dollar as markets anticipate no further rate hikes from the Bank of England (BoE) this year. The currency has declined over 4% in September, marking its largest monthly drop since August 2022. Last week, the BoE held rates for the first time since December 2021, citing slowing economic growth and unexpected cooling in inflation. The pound briefly touched $1.2135, its lowest since March 2023, but is still up nearly 18% from last year. Upcoming consumer credit and mortgage data could maintain pressure on sterling.

Upcoming Events to Watch

- OPEC Meeting (Oct 4): As oil prices near $100 per barrel, OPEC convenes with a 30% price rally since June. Saudi Arabia and Russia’s extended production cuts make further supply reductions unlikely at this meeting.

- RBA Rate Decision (Oct 3): With Australian inflation at 5.2%, up from 4.9% in July, the RBA meets to consider future rate hikes. The bank may await Q3 CPI data, due later in October, before deciding on rate adjustments.

- US Non-Farm Payrolls: After a mixed August report, the market and the Fed will scrutinize September’s data for signs of labor market cooling. Expectations are for 150k new jobs, 0.3% MoM wage growth, and a 3.7% unemployment rate.

- Eurozone Retail Sales (Oct 4): Amid economic concerns, Eurozone retail sales data is awaited. Sales dropped 1% MoM in August, as inflation remains double the ECB’s target, fueling recession fears for H2.

- China Caixin PMIs: Recent data hints at economic improvement in China. Manufacturing PMI is expected to rise to 51.4, while markets will watch for the services sector to continue its expansionary trend from 51.8 in August.

Technical Analysis

We have analyzed the most popular trading pairs and assets, including EUR/USD, GBP/USD, Gold, and US500. Our aim is to provide you with an insightful analysis of their trends and support/resistance levels, which will help you make informed decisions.

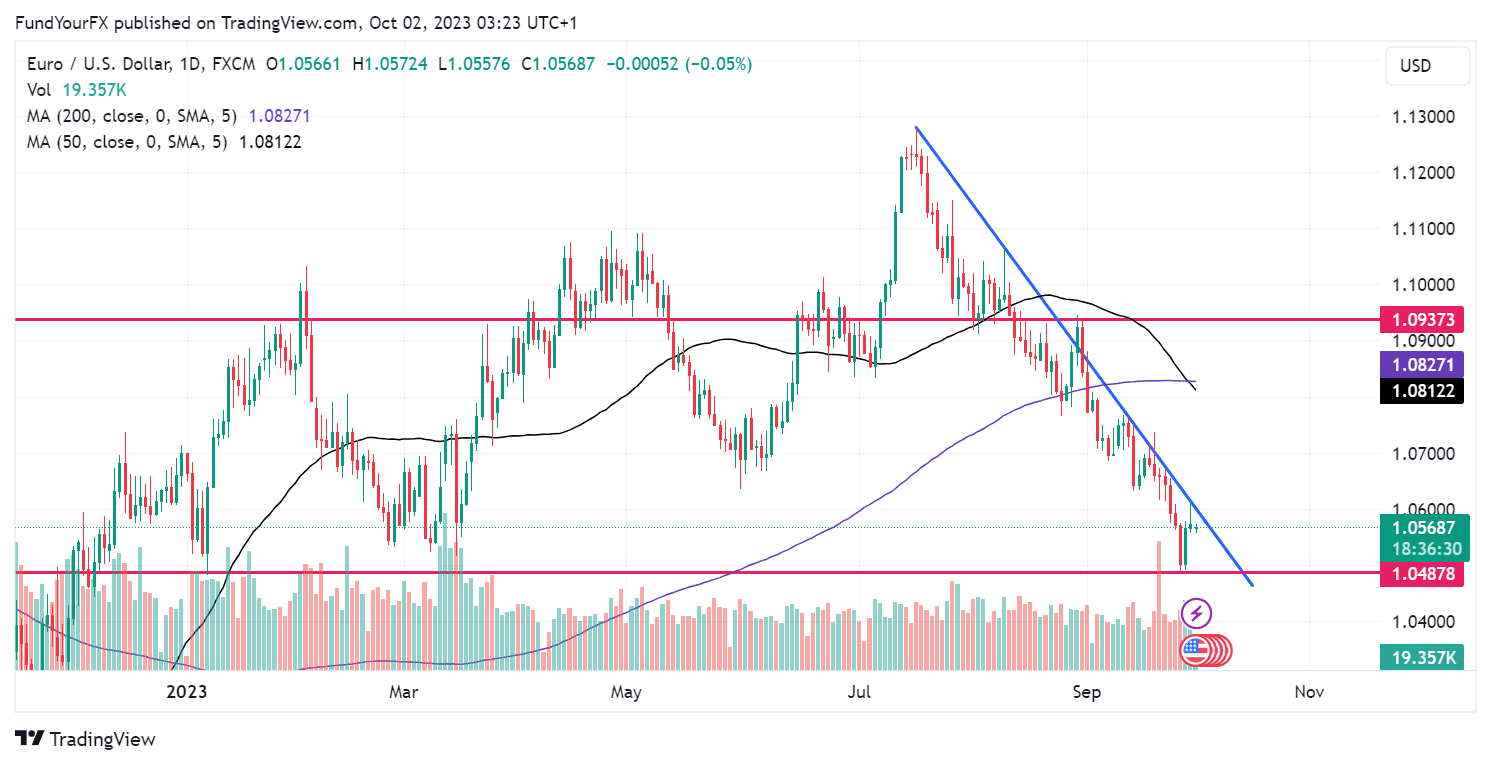

EUR/USD

Last month, the EUR/USD pair faced a strong bearish trend, largely driven by the U.S. Dollar’s resilience. Despite this downward momentum, the pair found robust support at the 1.05 level. After a prolonged bearish run, the price reached this key daily support level, which has historically served as a strong barrier against further declines. Recently, a bullish candlestick pattern has appeared on the daily chart, signaling potential upward movement.

GBP/USD

On Friday, the GBP/USD pair started off strong but then dropped as more people started buying the US Dollar. Big investors are mostly betting that the pair will keep going down, possibly hitting the 1.21 level or even lower. The last two price bars closed higher, breaking the downward trend. This could either be the start of the pair going up or just a temporary bounce back, especially since it just filled a weekly price gap.

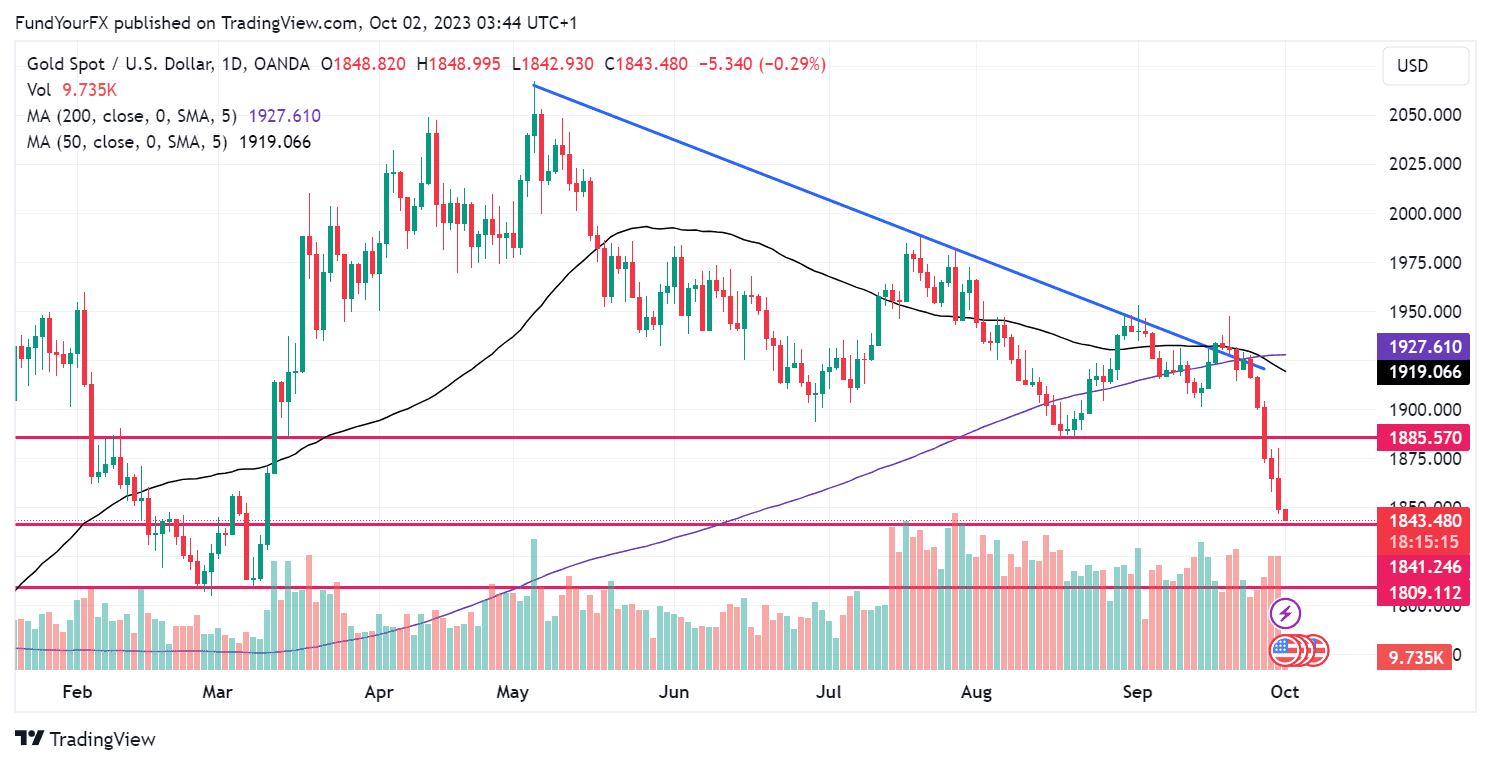

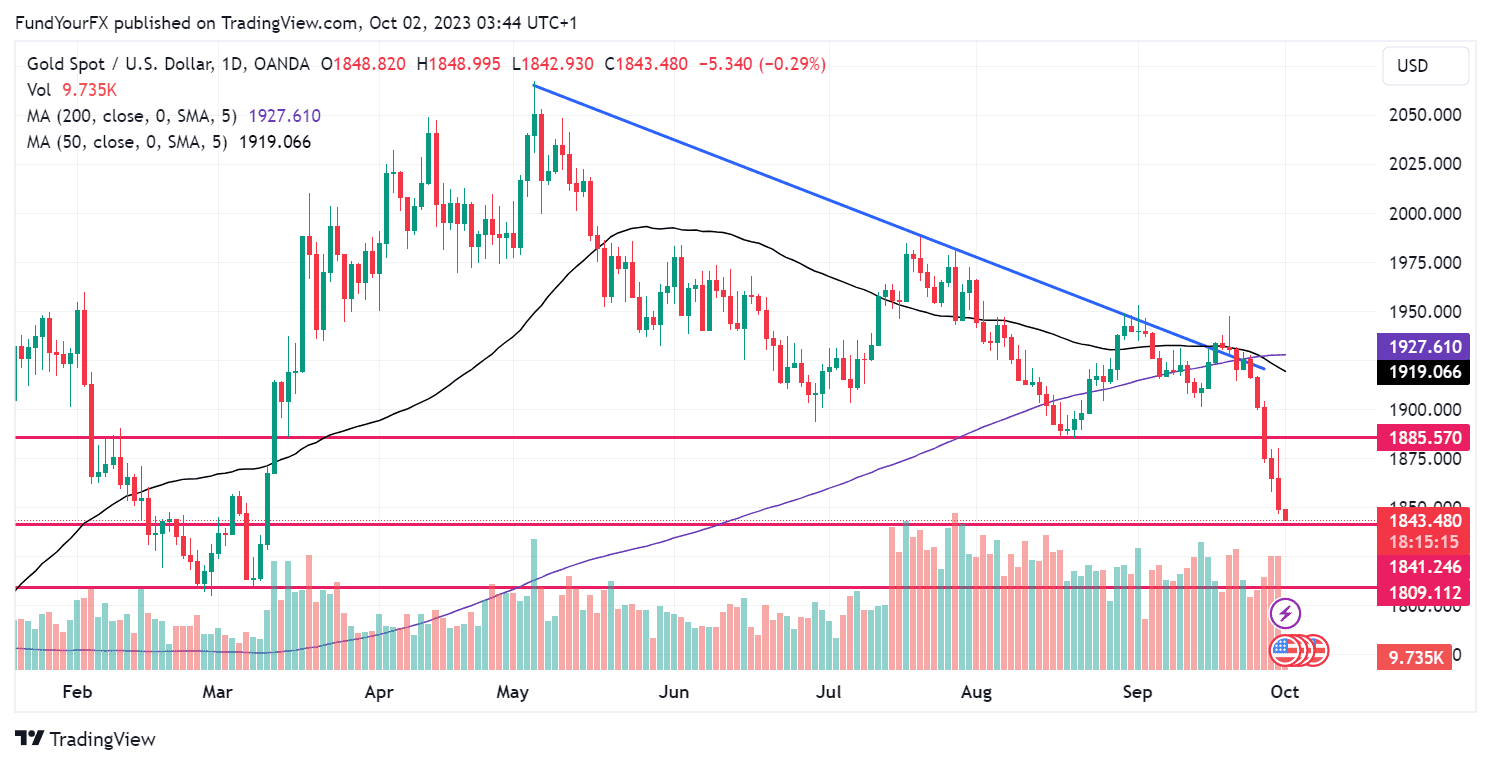

XAU/USD

Last week, gold prices dropped a lot. Gold is currently on a downward trend, sitting at the 1837 level. There might be a small, temporary bounce back. After that, it’s possible that the price could fall further to test the support levels at 1809 and 1788. This happened when the US Federal Reserve, or the Fed, decided not to change interest rates and said they’ll keep rates high for longer than we thought before. Even though gold is having a tough time, a recent weekly survey by Kitco News shows that most experts believe gold prices will go back up soon.

XUS500

The S&P 500 has been going down for over two months, hitting a key trendline. It is also on a downward trend, with its price consistently dropping below the 50-day average. The RSI indicator shows it’s oversold, being under 35. However, the price recently made a “hammer” pattern at the 4250 level, which could mean it might bounce back soon and maybe even end the big drop that started at 4600.

Thank you for reading! Wishing you successful trades ahead!

Unlock your trading potential with FundYourFX, the award-winning instant funding prop firm. Experience real funding from day one, flexible trading rules, and profit share of up to 70%. Visit FundYourFX now and start achieving your trading goals today!