Welcome to the Weekly Market Update!

In this edition, we bring you the latest highlights and insights from the world of finance. We will cover the week’s top stories, provide market analysis, highlight economic developments, discuss upcoming events to watch, and present technical analysis. Let’s delve into the key information you need to stay informed and make informed financial decisions.

Top Stories of the Week

- ARM Debuts on Nasdaq: The British semiconductor firm launched its IPO at a share price of $51, achieving a market valuation of approximately $54 billion.

- U.S. Inflation Climbs: The headline Consumer Price Index (CPI) ascended to 3.7%, a jump from the previous 3.2%, while core inflation eased to 4.3% from 4.7%. These figures bolster the likelihood of the Fed maintaining current interest rates.

- Apple’s Latest Launch Falls Flat: Unveiling the iPhone 15 without any price changes, Apple failed to excite the market, resulting in a share price decline.

- EU Investigates Chinese EV Subsidies: In an effort to protect domestic electric vehicle manufacturers, the European Union has initiated an inquiry into China’s subsidies for its EV sector.

- Oracle Plummets on Weak Outlook: Despite beating earnings expectations, the software giant missed its revenue targets and offered lackluster guidance for the current quarter, leading to an 11% drop in its stock price.

Market Analysis

- Oil Prices Hit Near 10-Month Peaks: Brent and WTI crude surged to $92.06 and $88.84 per barrel, their highest since November 2022. OPEC’s optimistic demand forecast and voluntary supply cuts by Saudi Arabia and Russia fuel the rally. The EIA projects global oil output to rise, but anticipates a tighter market, with Brent potentially averaging $93 by Q4 2023. Upcoming data from the IEA and API are eagerly awaited.

Economic Highlights

- UK Economy Faces Unexpected Downturn: Official data reveals a sharper-than-expected 0.5% contraction in the UK’s GDP for July, defying forecasts of a 0.2% decline. Strikes in healthcare and education sectors, coupled with adverse weather, impacted all major economic sectors—services, manufacturing, and construction. The Sterling also took a hit, shedding value against the dollar. Experts like Neil Birrell from Premier Miton warn that the rapid deceleration could signal an impending recession, exacerbated by rising unemployment and persistent inflation concerns.

Upcoming Events to Watch

- FOMC Rate Decision (Sep 20): As the Fed convenes amid rising inflation but cooling core rates, markets are eyeing a 40% chance of a November rate hike. The decision is highly anticipated given that inflation remains above the Fed’s 2% target.

- BoE Rate Announcement (Sep 21): Mixed economic indicators make the BoE’s upcoming decision less straightforward. With inflation still triple the target and signs of economic cooling, all eyes are on whether this could be the BoE’s final rate hike.

- BoJ Policy Update: Talk of shifting from ultra-easy monetary policy grows among BoJ policymakers. While no major changes are expected, investors will scrutinize language shifts. A less dovish BoJ could impact USD/JPY trading.

- FedEx Earnings Report (Sep 20): After ending fiscal 2023 positively, FedEx is set to announce Q1 earnings. Market expectations are for a YoY EPS increase to $3.71 on $21.79 billion revenue, down 7.5%.

- Eurozone PMI Data: The eurozone’s economic outlook continues to darken. This week’s PMI data is expected to confirm the trend, raising recession fears for H2 as manufacturing is likely to slow more than services.

Technical Analysis

We have analyzed the most popular trading pairs and assets, including EUR/USD, GBP/USD, Gold, and US500. Our aim is to provide you with an insightful analysis of their trends and support/resistance levels, which will help you make informed decisions.

EUR/USD

The pair continues its bearish trajectory, registering lower highs and lows beneath the 50-day Simple Moving Average (SMA). The recent ECB conference failed to provide bullish signals, causing the euro to weaken further. The Relative Strength Index (RSI) suggests an oversold market in bearish territory. The outlook remains bearish, targeting a move towards 1.06, with resistance likely at 1.083 and 1.09.

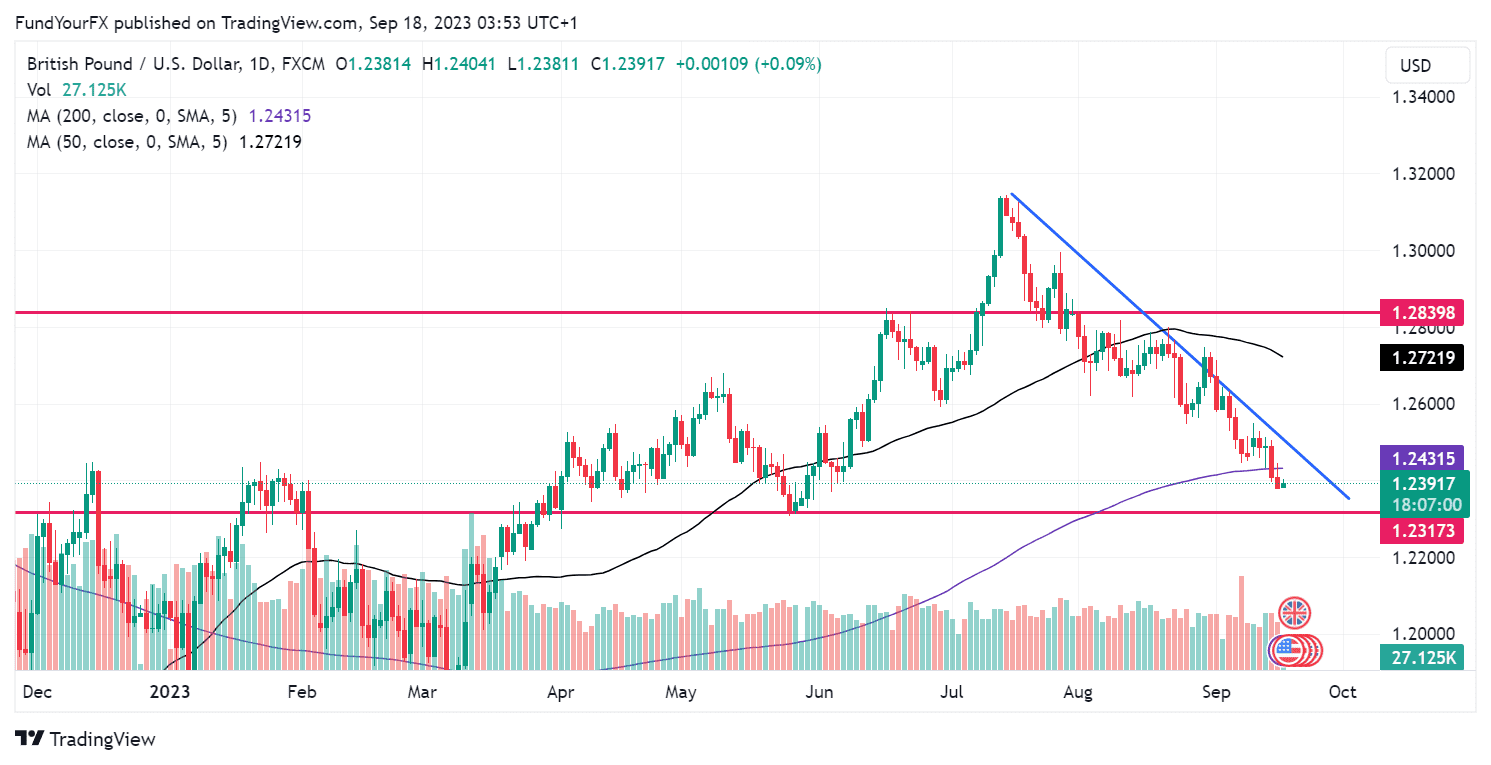

GBP/USD

The currency pair maintains a bearish trend, marked by declining highs and lows below the 50-day SMA. The RSI is nearing its yearly low reached in August but isn’t in oversold territory. A significant support level at 1.25 was recently breached, signaling that the pound’s prior bullish phase may be over. This bearish pattern is consistent across multiple GBP pairs.

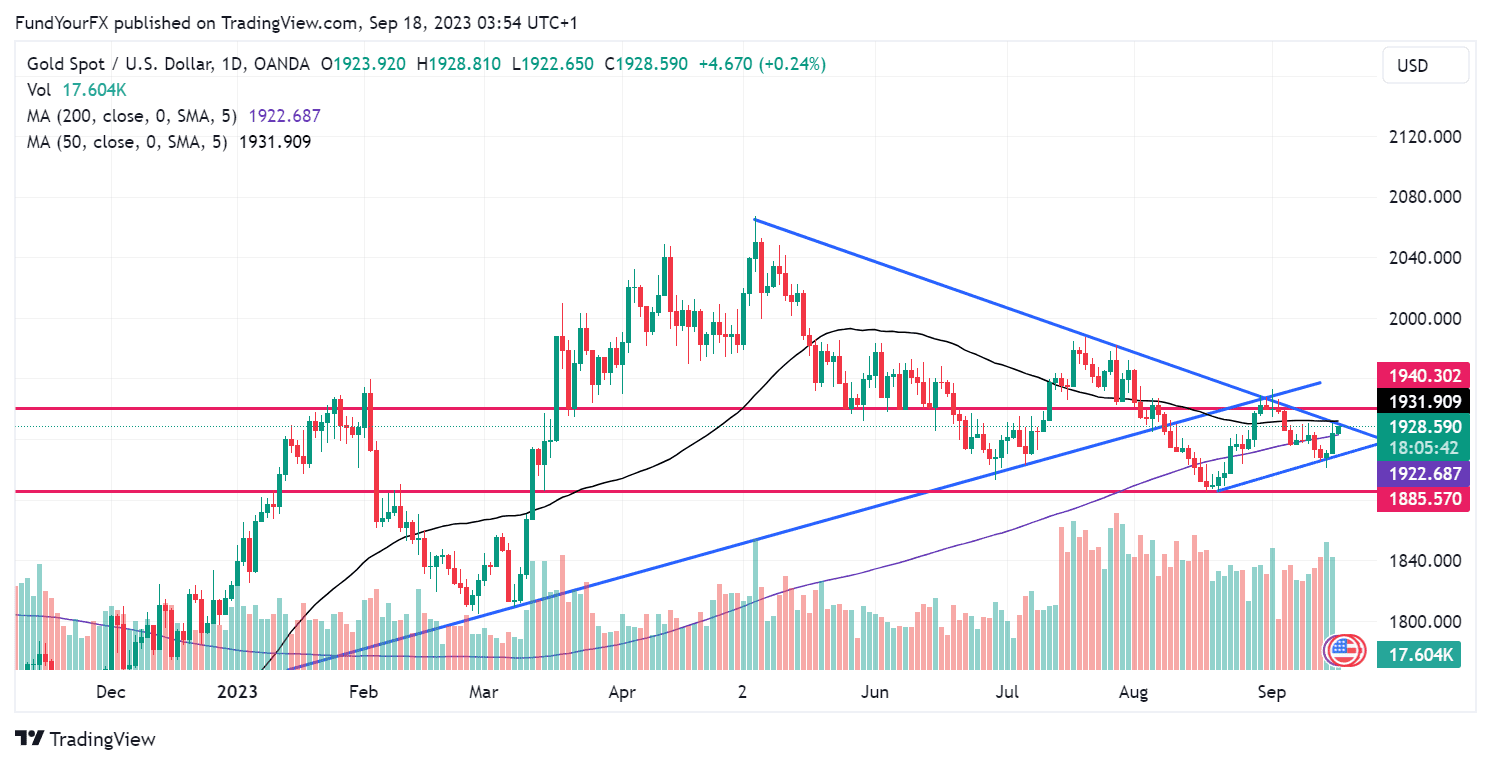

XAU/USD

Gold showed resilience over the weekend, closing above its Monday opening price. Despite challenges from a robust U.S. dollar in recent months, there are indications that gold may be reversing its downtrend relative to the dollar.

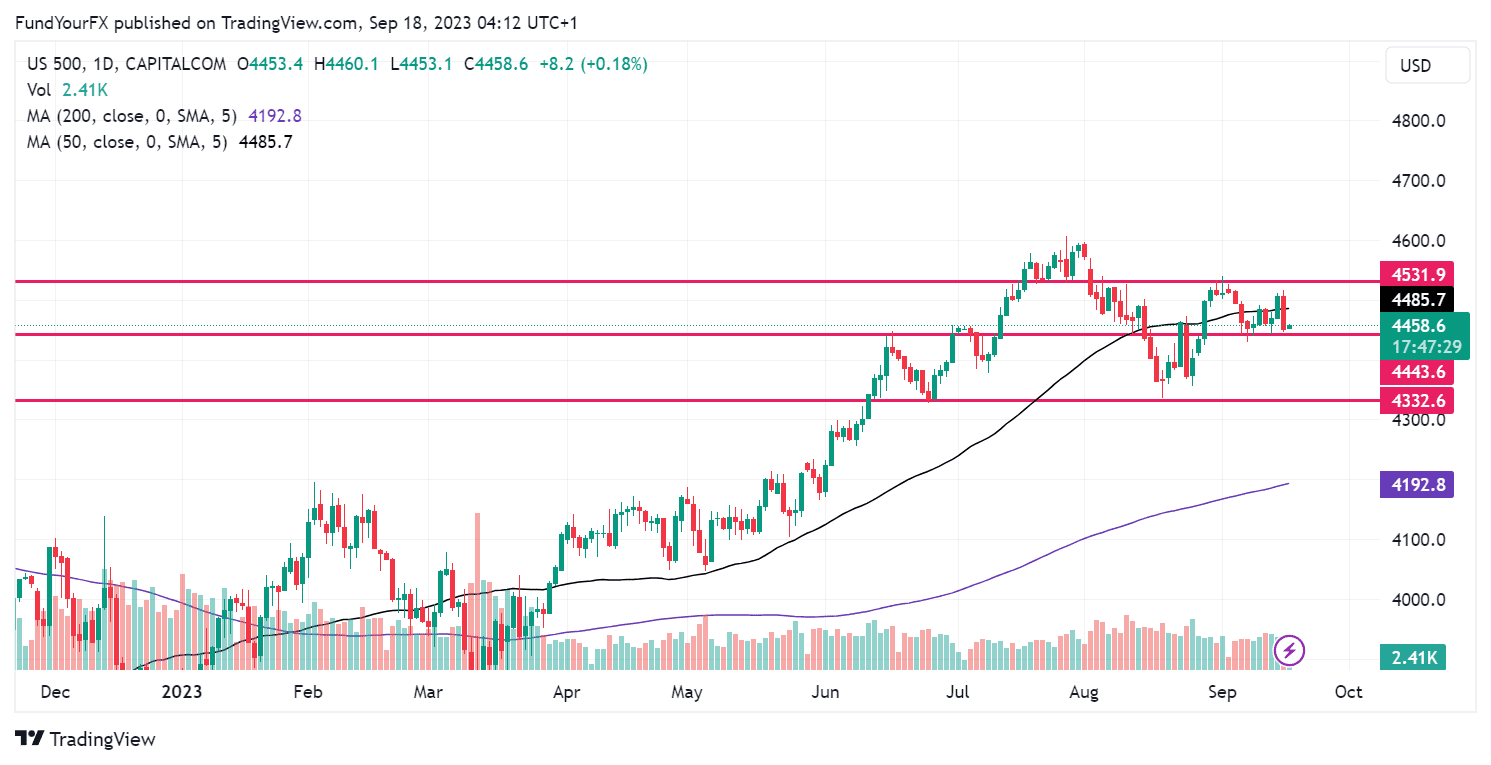

XUS500

The index is on an upward path, recording higher highs and lows, although it remains below the 50-day SMA. The RSI is in a neutral zone. After a robust 4-day rally, the market saw a 3-day pullback, suggesting a more range-bound trading environment.

Thank you for reading! Wishing you successful trades ahead!

Unlock your trading potential with FundYourFX, the award-winning instant funding prop firm. Experience real funding from day one, flexible trading rules, and profit share of up to 70%. Visit FundYourFX now and start achieving your trading goals today!