Leverage is a technique that uses borrowed money or capital to increase the potential profit or loss from an investment. Leverage can amplify gains, but it can also amplify losses if the investment does not succeed. Investors or companies typically use leverage to take advantage of investment opportunities by using borrowed capital to buy assets that are larger than what they could buy with their available funds. Using leverage, investors or companies can increase the potential return on their investments, but they must also be prepared to bear the increased risk if the investment does not succeed.

What Does Leverage Mean In Terms Of Trading?

In trading, leverage is a method that lets a person buy or sell things using money they borrowed from a broker. Most of the time, leverage comes in the form of a ratio, such as 100:1, 200:1, or 500:1. This ratio indicates how much-borrowed capital the broker will provide to the trader based on the amount of capital the trader has. For example, if a trader has $100 and uses a leverage of 1:100, they can conduct transactions worth $10,000. Leverage can help traders handle larger amounts of money, but if it isn’t used wisely, it can also make traders more likely to lose money.

How Does Leverage Function?

Brokers typically offer leverage in the form of a ratio, such as 1:200, which means that the trader can trade an amount of money equal to 200 times their capital.

Which Markets Are Available For Leveraged Trading?

Forex, commodities, indices, cryptocurrencies, and stocks are some examples of markets available for leveraged trading.

What Is Leverage Ratio?

A leverage ratio is the ratio of borrowed funds to a trader’s own funds for trading. For example, if a trader has $100 and uses a leverage of 1:10, they can conduct trades worth $1,000.

Which Leverage Is Best For Prop Trading?

Choosing leverage suitable for your trading strategy and the current market conditions is essential when trading. Most traders will use lower leverage when the market is volatile and higher leverage when the market is trending strongly. It is always recommended to start with lower leverage and gradually increase it as your skills and experience in trading improve. For example, you can start with a leverage of 1:100 and then increase it to 1:200 or 1:500 when you feel more confident in your trading abilities and favourable market conditions. It is also essential to remember that higher leverage can increase the potential for both gains and losses, so it is essential to use it wisely and manage your risk effectively.

Advantages Of Using Leverage

- Leverage allows traders to trade positions more extensively than the amount of capital they have. This allows traders to maximize their potential profits, particularly if they have limited capital.

- Leverage can also help traders better manage risk. Using leverage, traders can take smaller positions than the amount of capital they have, reducing the risk of loss if there is an unexpected price movement.

- Leverage can increase potential profits in the short term, as it allows traders to open positions with smaller amounts of capital. This allows traders to profit from small price movements that may not be possible with smaller amounts of capital.

- Leverage can also help traders enter and exit the market faster, allowing them to open and close positions with smaller amounts of capital.

- However, it is always important to remember that leverage can also increase the risk of loss, so make sure you have good risk management.

Disadvantages Of Using Leverage

- Leverage can increase the potential loss suffered by traders. For example, if a trader uses leverage 1:100, the loss will also be 100 times greater than if they did not use leverage.

- Leverage can accelerate the loss suffered by traders. In certain situations, if the market is very volatile, if the market moves very quickly, or if there is unexpected economic turmoil, traders who use leverage can lose all their capital quickly.

Is Leverage Trading Worth It?

Using leverage in trading can increase the profits that can be earned and the potential losses. Therefore, traders must understand the risks associated with leverage and use it carefully.

Therefore, leveraged trading can be considered worth it if traders understand the risks and use them wisely. However, traders do not understand the risks associated with leverage or use it excessively without knowledge. In that case, it will result in significant losses or even the loss of money in seconds.

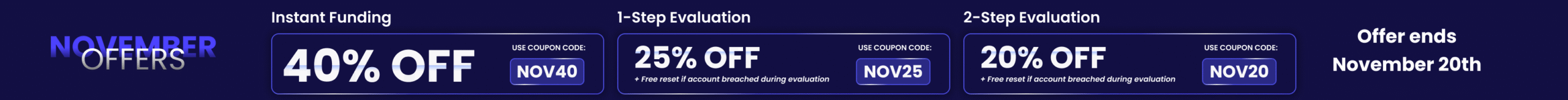

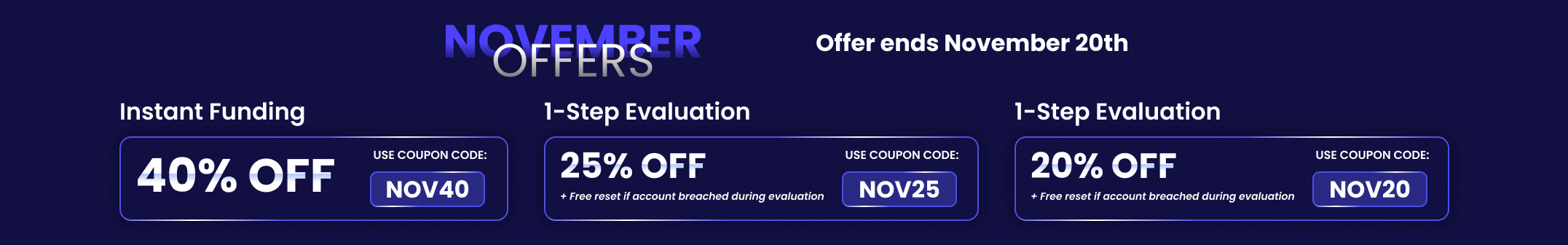

If you are interested in trading with FundYourFX, our leverage can go as high as 1:100. Leverage trading allows you to earn more money with a lesser investment. It is also essential to have a good risk management strategy, which should contain stops and limitations.