Understanding pennant patterns, both bullish and bearish, is essential for technical traders since they may suggest significant market activity. Here is an explanation of how pennants function and how to trade them.

What is a pennant pattern?

Pennant patterns are continuation patterns that appear on charts when there is a significant upward or downward movement in the price of a security or asset, followed by a consolidation period with convergent trendlines that creates a pennant before the price resumes its upward or downward movement. In a market with a bullish trend, a bullish pennant will emerge, while a bearish trend will produce a bearish pennant.

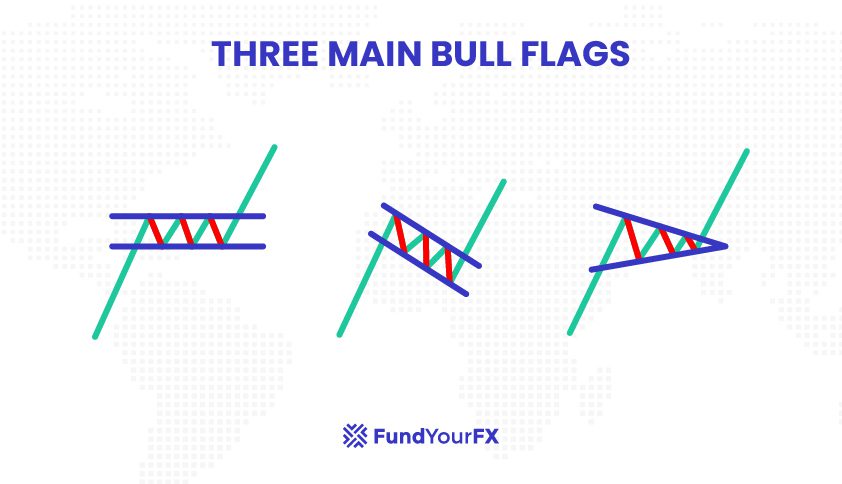

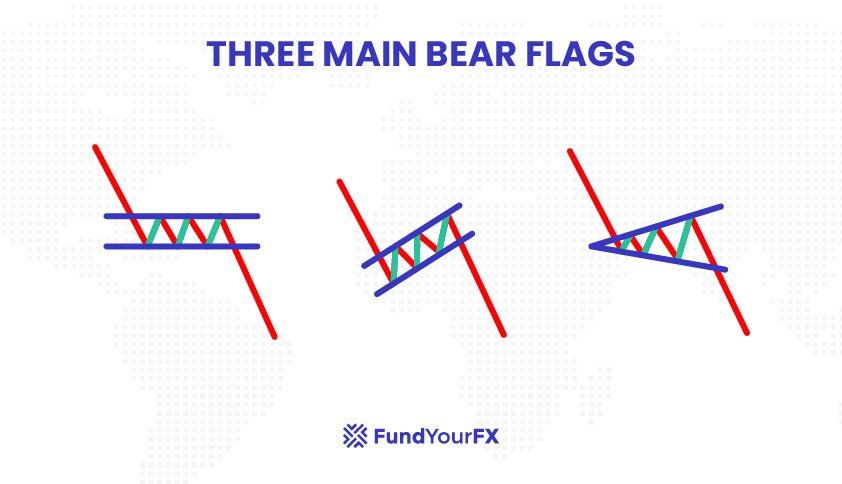

Is a pennant pattern different than a flag?

The primary difference between the pennant pattern and the flag pattern is that a pennant pattern’s consolidation phase is marked by converging trend lines as opposed to parallel trend lines. If you want to know more about the flag pattern, you can read our article on flag patterns here.

What is a bull pennant?

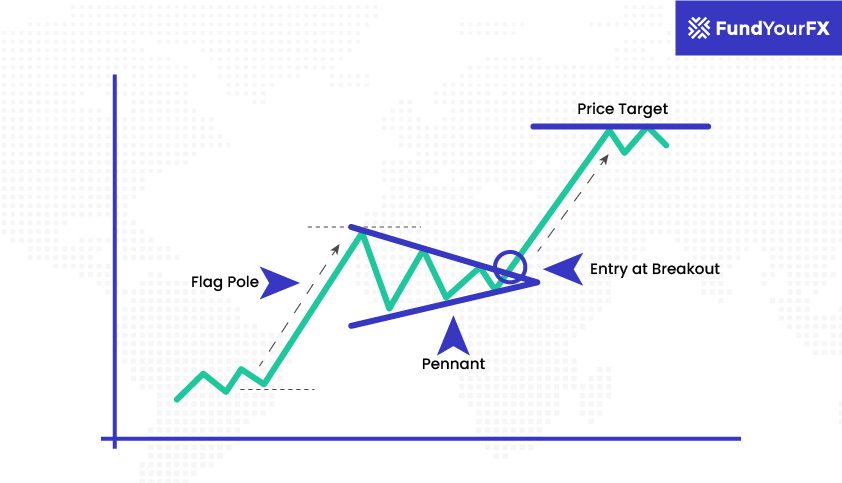

Bullish Pennants are a bullish continuation pattern that forms after a price increase that is quickly followed by a consolidation period with converging trendlines in strong uptrends. Price breaks above the top trendline of the pennant after it forms, continuing the bullish trend.

What is a bear pennant?

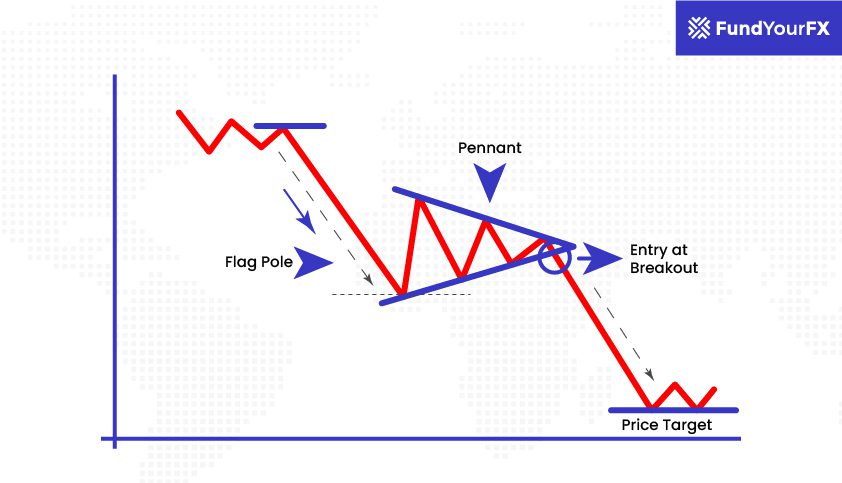

The opposite of a bullish pennant is a bearish pennant. A bearish pennant forms following a significant fall in price, followed by a period of consolidation with converging trendlines, and finally a break-out in the price below the pennant’s bottom trendline.

What is the difference between a bull pennant and a bear pennant pattern?

Strong uptrends are characterized by bullish pennants, which are continuation candlestick patterns. The Pennant is made up of an upward flagpole, a period of consolidation, and the uptrend continuing following a breakout.

The opposite of a bullish pennant is a bearish pennant. Strong downtrends tend to produce bearish pennants, which are continuation patterns. They usually begin with a flagpole: a sharp decline in price, followed by a halt to the trend. This pause creates the triangular “Pennant” shape. After a breakout, the downward movement continues.

Is the bull and bear pennant accurate?

The Head and Shoulders Pattern has a success rate of 83.04%, making it the most reliable pattern according to Cody Hind’s 2020 study, which tested 10 years of data and over 200,000 trading patterns. The Bearish Pennant Pattern has a success percentage of 55.19 percent, whereas the Bullish Pennant Pattern has a success percentage of 54.87 percent, making it the least reliable pattern. The flag patterns are more accurate than the pennant patterns. The success percentage for flag patterns is a little under 70%. If you want to know more about the list of the trading patterns, you can read our post “16 Price Action Patterns And Their Percentage of Success“, where we list all the patterns in the order of their success rate.

How to trade a bull and bear pennant?

Because they frequently result in lengthy breakouts, pennants are sought by day traders. Therefore, while trading them, you want to locate the ideal opening position and ride the subsequent move.

There are primarily two approaches available here. The first is to simply wait until the market crosses above its trend line, which serves as a line of support for bearish pennants and a point of resistance for bullish ones.

The second is to follow the basic principle that markets frequently experience a temporary reversal just prior to a strong breakthrough. In certain situations, resistance changes into support, while the previous support changes into resistance.

The lowest point of the pennant pattern is where the stop-loss level is placed.

The height of the starting flagpole to the point at which the price separates from the pennant is used to determine the price target for pennants.

Bottom Line

A technical pattern called pennants is used to spot the continuation of sudden price movements. While bullish pennants appear when bull movements pause, bearish pennants do the opposite. Planning when to enter a position, take a profit, and exit a position while trading them is necessary. Remember that market movement aren’t always what you expect, therefore, traders should constantly practice responsible risk management. Always trade with money you can afford to lose.