Trading the Trends

You will get an understanding of what trend trading is, the principles of trend trading, as well as the potential benefits of engaging in trend trading by reading this article. So it is our sincere hope that reading this article will provide you with a solid foundation upon which to build your knowledge of trading the trends.

What is Trend Trading?

A price trend can simply be defined as an extended period of rising prices. This is possible with any type of financial instrument. The stock market, the futures market, and the foreign exchange market all experience trending.

One of the most well-known quotes is “The trend is your friend,” which perfectly captures the idea that following trends may be beneficial. According to the proverb, if the value of an asset is already increasing, it will continue to do so. When it comes to assets that are decreasing in value, the opposite is also true. The movement of the markets in a broad direction over a longer time is something that becomes increasingly clear as time goes on. This might go in either direction: up or down.

One advantage of trend trading is that it enables traders to profit from trends in either the up or down direction. You should participate in that trend by purchasing whenever there is evidence of an upward tendency. If the market is moving in a bearish direction, you should consider going short on some of your positions.

One of the benefits of using this trading strategy is that it may be used in several markets alongside other comparable or even identical trading strategies. Trading with the direction of a market trend can be profitable in the futures and commodities markets, the foreign exchange market, the cryptocurrency market, indices market, and the stock market.

How to Trend Trade?

If we want to trade trend pullbacks successfully, the first thing we need to be able to do is to determine whether or not a market is trending or if it is range-bound. There is no reason to anticipate that the market will bounce back after the retreat since the pullback pattern does not apply in range-bound settings because there is no actual trend in price direction. As a result, there is no reason to predict that the market will go higher after the pullback.

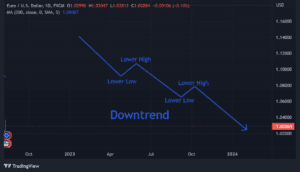

Despite the numerous ideologies and signs around it, trend spotting is a rather straightforward process. A pattern of higher highs and higher lows over time might be defined as a trend (vice versa on the short side). The trend is getting stronger as higher highs, and lower lows continue to occur in succession.

Swing Trading vs Trend Trading

Before we begin, we feel it is important to discuss different time frames’ roles in identifying trends. When researching assets with a long time frame, we almost always give more weight to the long-term time frame than to the shorter time frames. On the other hand, the shorter time period may be more useful for day trading reasons. Day trading, swing, and position trading are the three primary categories of trading strategies or market sectors that may be utilized while making trades.

Swing traders are more concerned with short-term price swings, whereas trend traders prefer to concentrate on more general economic news. Unlike trend traders, swing traders engage in trading more often and for a shorter time. In addition, swing traders take larger positions and are more accurate when it comes to timing their position changes.

How to Identify Trends?

Using trendlines, which are lines that link a succession of highs (uptrend) or lows (downtrend), is a typical method for identifying trends (uptrend). A support level is established for the subsequent price movements when an uptrend is formed by connecting a series of higher lows. When prices move downward, this forms a downtrend, which connects a sequence of lower highs and creates a resistance level.

What are the Benefits of Trend Trading?

- Your risk-to-reward ratio may be higher. Because you are evaluating the movements and histories of a certain asset, there is a possibility that you will have a greater probability of selecting the appropriate periods to purchase or sell.

- Trading using trends simplifies the process of spotting strong market movements. This helps mitigate the problems caused by a set of buy and sell rules that are not ideal.

- Trading with the trend is a strategy that may be applied to virtually any market, including futures, commodities, securities, and cryptocurrencies.

How much capital do you need to trend trade?

The beauty of trend trading is that it is a simple and effective trading strategy that can be used in various markets, such as the stock market, the foreign exchange market, the futures market, and the cryptocurrency market. Whether you are trading with a small or large account, trend trading can be a profitable trading strategy if executed correctly.

It is important to note that while trend trading does not require a minimum amount of funds, having a larger trading account can provide more flexibility and opportunities to maximize profits. With a larger trading account, traders can take on larger positions, resulting in higher profits if the trades are successful.

If you want to trend trade with a larger capital, you can always join FundYourFX.

How to trend trade with a bigger capital?

You can quickly become a member of a prop trading firm like FundYourFX, for instance. One of our 3 Funded Trader Programs can provide you with quick and easy access to instant funding. There is funding available in the amounts of $6,000, $15,000, and $30,000. Due to the fact that we do not make money off of demo-account challenges, you will be able to start trading as soon as you pass our interview.

If you are continuously profitable, your start-up capital will double for every 10% rise in profit. When you are managing accounts worth up to $1,000,000 and taking home profit shares of up to 50%, you will be able to take home the maximum amount of profit possible. If you enjoy trading with larger sums of money, there is no reason for you not to make a career from the capital currently accessible to you and use it.

In summary

Trend trading is not only extremely straightforward but also profitable, as we have demonstrated to you. Indicators may, among other things, simplify price information while also offering trend trading indications and cautions about reversals. Indicators may be applied to any and all time frames, and the vast majority of them come with various parameters that can be customized to meet the individual requirements of each trader.