Welcome to the Weekly Market Update!

We are here to provide you with the pivotal financial happenings and insights. Our focus is on the primary stories of the week, alongside a deep dive into market dynamics, economic milestones, events to monitor, and technical forecasts. Here’s the essential roundup to keep you savvy and ready for strategic financial moves.

Top Stories of the Week

- Fed Outlook Shifts Amid Hawkish Comments: Markets reined in bets of an early Fed cut. Hawkish Fed commentary and stronger-than-expected retail sales saw the market dial-back rate cut expectations.

- Surprise Jump in UK CPI Hits 4%: UK CPI unexpectedly rose to 4%, with core inflation also remaining sticky at 5.1%. The market reined in BoE rate cut bets, with the first rate cut fully priced in for June.

- ECB Signals Potential Summer Rate Cut: ECB President signaled a summer rate cut. Christine Lagarde said that she sees a rate cut in the summer. Other ECB officials painted mixed messages with regard to rate cuts. EUR/USD fell below 1.09.

- Apple Reacts to Chinese Market Pressure: Apple cut iPhones in China. The tech giant made the rare move of cutting iPhone prices in China, highlighting the pressure that increased local competition Apple is facing.

- USD/JPY Rally Continues on Shifting Market Sentiment: USD/JPY rally continued. The pair rose for a third straight week, hitting a weekly high as the market reined in dovish Fed bets and hawkish BoJ expectations.

- Goldman Sachs Reports Strong Profits: Goldman Sachs posted profits. The investment bank posted a 51% rise in profits thanks to the asset and wealth business rather than the investment banking business.

- Tesla Takes Bold Move with Price Reductions: Tesla cuts prices. The EV maker slashed prices across Europe, including in Germany, where it also lost the crown as the top EV producer to Volkswagen.

- Mixed Q4 Earnings for Morgan Stanley: Morgan Stanley posted mixed Q4 earnings. The investment bank was hit by heavy regulatory charges, and CEO Ted Pick warned of major downside risks ahead.

- China’s GDP Falls Below Expectations: China’s GDP was weaker than expected. China’s GDP rose 5.2%, below the 5.3% that was expected but up from 4.9% previously. Oil prices fell after the data.

- Strong Start for Bitcoin ETFs: Bitcoin ETFs pulled in $871M in the first 3 days of trading. According to CoinShare, BlackRock led the way with $723 million, followed by Fidelity with $545 million. The inflows were offset by $1.18 billion in outflows at Grayscale

Market Analysis

- US Dollar Surges on Economic Resilience: The US dollar’s ascent dominates headlines, bolstered by the perceived resilience of the US economy and trader skepticism regarding imminent rate cuts. In contrast, the Japanese yen faces challenges, grappling with a blend of economic data and the aftermath of a catastrophic earthquake. This seismic event prompts a reevaluation of the Bank of Japan’s policy outlook, adding volatility to currency markets.

Economic Highlights

- Tech Boom Fuels Asian Markets: Japan’s Nikkei and Taiwan’s stock market experience substantial growth, propelled by a surge in semiconductor stocks. TSMC’s projection of over 20% revenue growth takes center stage, setting these markets apart from global trends. The robust performance of the tech sector becomes evident, showcasing resilience amid broader market movements.

Upcoming Events to Watch

- ECB Meeting (Jan 25): The ECB convenes on Thursday, January 25, with a keen focus on market expectations versus official comments. Despite data aligning with projections post-December, including a headline inflation uptick, the ECB is likely to maintain interest rates, offering minimal insight into potential future cuts. With caution prevailing, the ECB acknowledges the unfinished task amid factors like weakened demand and potential Middle East tensions affecting inflation.

- US Core PCE (Jan 26): The US core PCE, a key gauge for inflation, takes center stage on Friday, January 26. As CPI inflation edged higher in December, attention turns to whether core PCE aligns with the Fed’s 2% target. Personal spending figures will be scrutinized for indicators of a resilient consumer, supporting the narrative of a soft landing.

- Netflix Earnings (Jan 23): Netflix is set to announce earnings on January 23, with expectations of an EPS of $2.24 on $8.71 billion revenue. Anticipating growth from a password-sharing crackdown and a low-cost advertising subscription plan, Wall Street closely watches subscription numbers, with the $6.99 ad-supported tier gaining traction in a competitive market.

- Tesla Earnings (Jan 24): Tesla reports Q4 earnings on January 24, projecting an EPS of $0.74 on revenue of $25.76 billion. Despite a 20% increase in deliveries for Q4 2023, the EV market’s cooling, high-interest rates, and price cuts impact Tesla’s performance. With a focus on market share, investors await insights into Tesla’s strategies amid evolving market conditions.

- BoC Rate Decision (Jan 24): The Bank of Canada’s first rate announcement for 2024 is scheduled for Wednesday, January 24. After maintaining interest rates at 5% in December, expectations point towards a continued hold, potentially until mid-2024. Despite a rise in Canadian inflation to 3.4%, hopes of an early monetary policy loosening fade. Clues regarding the timing of the first rate cut will be under scrutiny in the market.

Technical Analysis

We have analyzed the most popular trading pairs and assets, including EUR/USD, GBP/USD, Gold, and US500. Our aim is to provide you with an insightful analysis of their trends and support/resistance levels, which will help you make informed decisions.

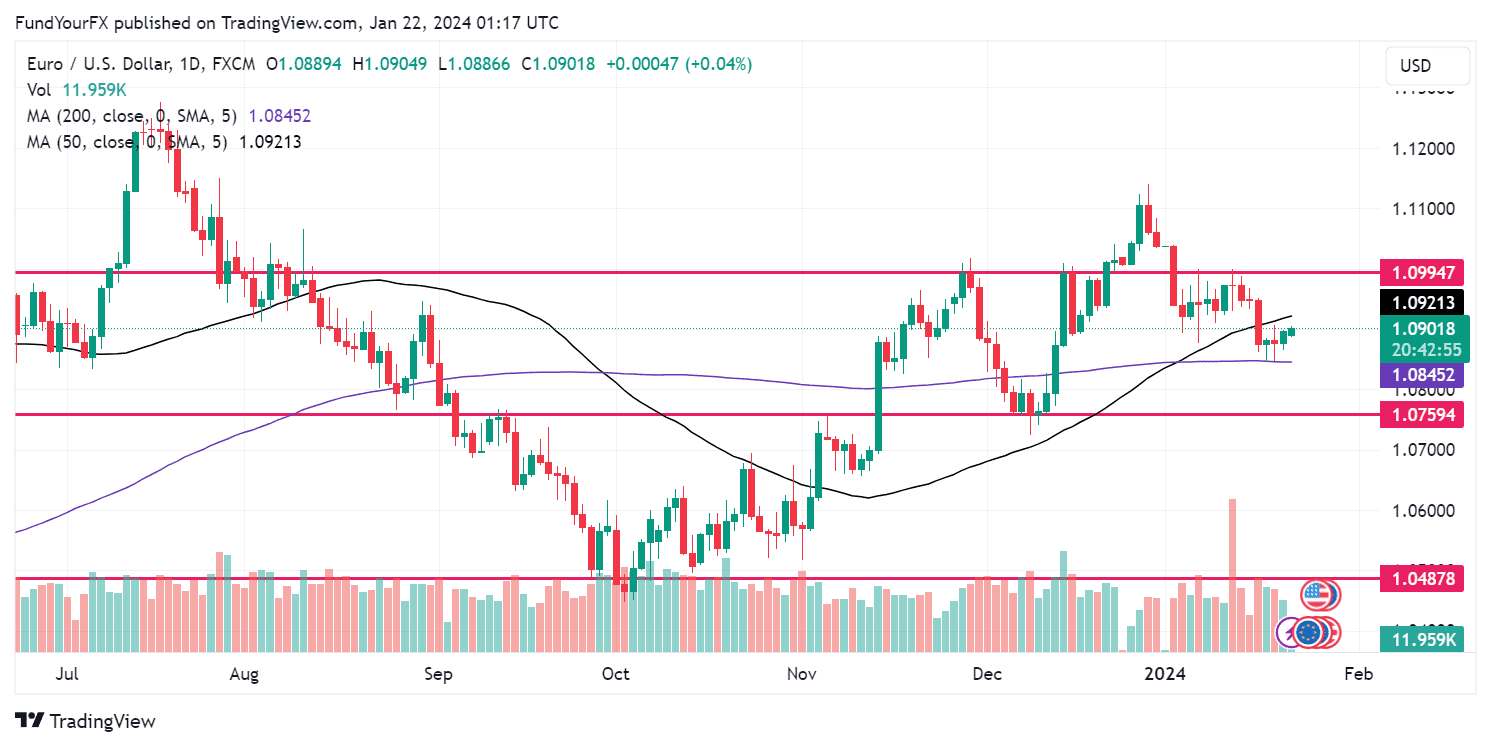

EUR/USD

The EUR/USD pair is currently exhibiting a neutral to bearish trend, having recently dipped below the 50-day Simple Moving Average (SMA). This indicates a potential change in market direction. Key support levels are at 1.07098 and 1.0508, with resistance observed at 1.0928 and 1.1462. The Relative Strength Index (RSI) stands at 43, leaning towards a bearish momentum, suggesting the possibility of further downward movement. The expectation is for the price to oscillate within the current support range before potentially embarking on an uptrend, or conversely, continuing its descent by establishing a new low.

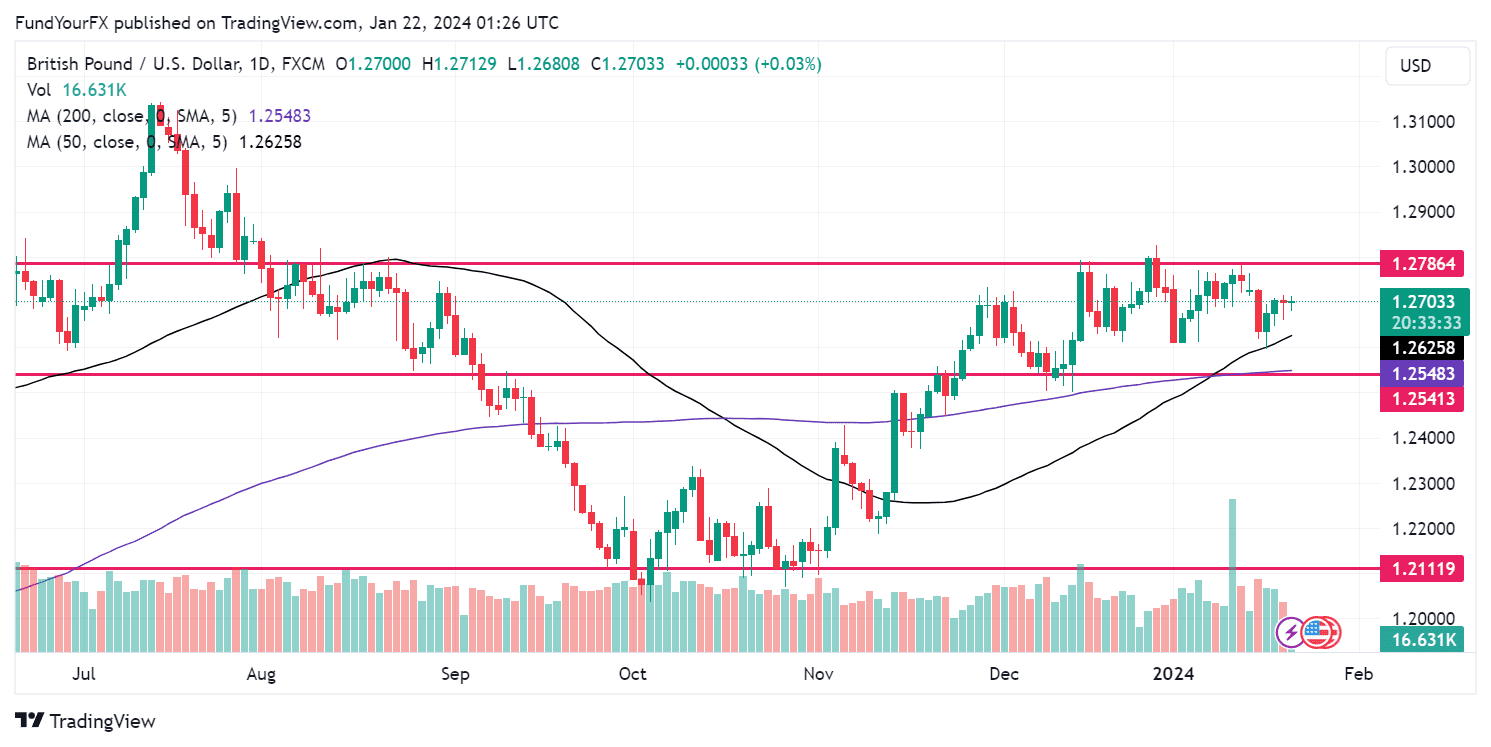

GBP/USD

The GBP/USD pair is currently showing a trend that is bullish to neutral, as it remains above the 50-day Simple Moving Average (SMA) but is exhibiting mixed highs and lows. This pattern suggests that while the upward momentum is ongoing, it is losing some of its strength. Given the pair’s recent behavior around the current resistance level, there’s an expectation of a potential trend reversal, possibly leading to a downward trend. A break below the support levels at 1.2399 and 1.2128 would confirm this bearish shift. The Relative Strength Index (RSI) is at a neutral 50, indicating a consolidation phase where the market could move in either direction.

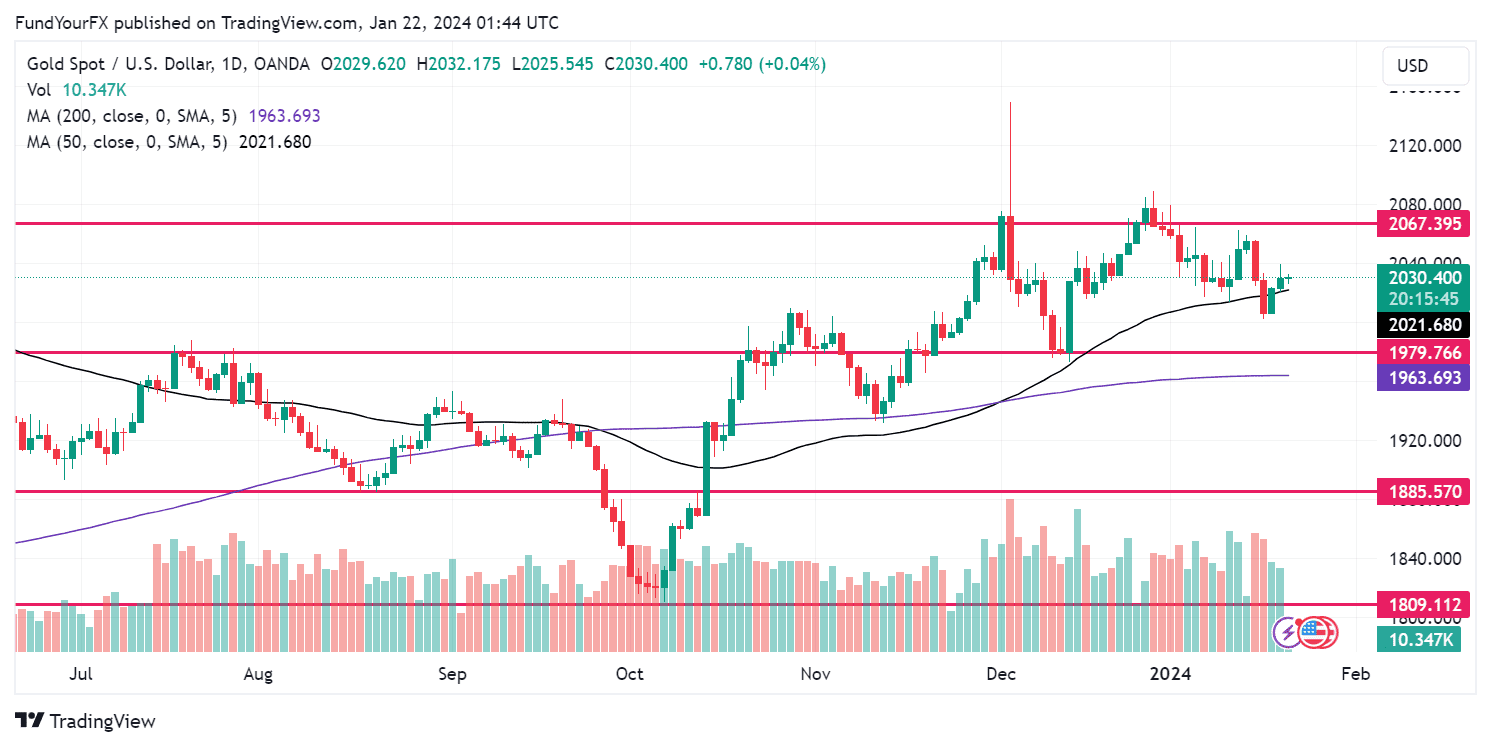

XAU/USD

Gold (XAU/USD) is currently exhibiting a neutral to bearish trend, as it trades below the 50-day Simple Moving Average (SMA) and is forming lower highs, indicating a loss in upward momentum. The expectation is that the price might undergo a trend reversal in the current resistance range, potentially initiating a downward trend. Key support levels are identified at 1964.44 and 1902.00, while resistance levels are at 2025.97 and 2080.79. The Relative Strength Index (RSI) stands at 44, leaning towards bearish momentum, suggesting there could be room for further downward movement.

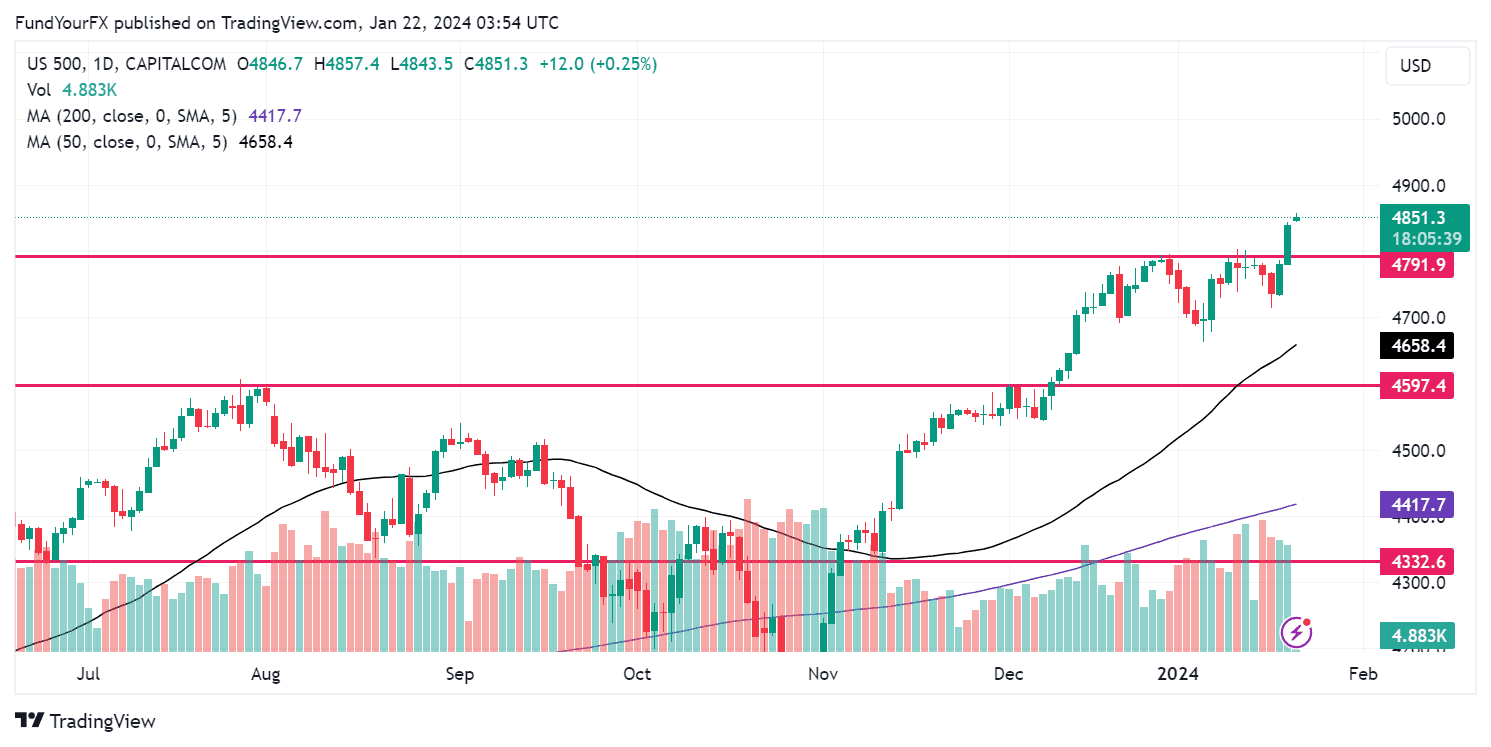

XUS500

The S&P 500 Index is exhibiting a bullish trend, consistently trading above the 50-day Simple Moving Average (SMA), even with recent pullbacks. It has recently hit a one-year high, indicating strong upward momentum. However, there’s an expectation of a short-term retest of lower support levels. Long-term projections remain positive. The index has support at 4717.57 and 4565.90, with resistance at 4806.55. The Relative Strength Index (RSI) at 57.85 suggests the market has healthy bullish momentum and is not overbought, indicating potential for continued growth.

Thank you for reading! Wishing you successful trades ahead!

Unlock your trading potential with FundYourFX, the award-winning instant funding prop firm. Experience real funding from day one, flexible trading rules, and profit share of up to 70%. Visit FundYourFX now and start achieving your trading goals today!