Introduction to Low Volatility Markets

Markets with low volatility bring their own set of challenges and perks. Unlike the fast-paced high volatility markets ripe for quick gains, low volatility scenes offer smaller and less frequent price changes. Traders need to fine-tune their strategies to harness the potential of these subtler market movements.

Mastering low volatility markets isn’t just about tweaking your trading style; it’s about sensing the delicate market shifts and responding with strategic insight. In such environments, the high-energy trading is replaced by more controlled movements, emphasizing the need for patience and calculated planning. Quick, impulsive decisions common in volatile settings might not cut it here.

This post aims to navigate you through the low volatility trading landscape. We’ll unpack the key elements of understanding these markets, underscore the importance of detailed market analysis, and show you how to adjust your trading game to fit the calm yet fruitful nature of low volatility scenes. Covering everything from risk management to the mental game of trading, and optimizing tech tools, we’ll equip you to excel in low volatility markets, regardless of your trading experience.

Understanding Low Volatility Markets

Low volatility markets may seem less thrilling compared to their high volatility siblings, yet they hold special allure and potential for savvy traders. Grasping low volatility’s essence and its impact on trading is critical for adapting your approach effectively.

Here, market prices fluctuate mildly over time, evident in tight price bands and subdued movements. These conditions often accompany lower trade volumes and may stem from stable economic scenarios, minimal headline news, or investor consensus on asset pricing.

In such markets, price changes are minor and evolve slowly, missing the dramatic spikes of more volatile arenas. This perceived stability reduces fast profit chances but opens up opportunities for steady gains.

Successful trading in these calm waters requires strategic shifts. Quick scalping or momentum trading common in high-volatility settings may falter, urging a focus on strategies that exploit small, incremental price changes. It’s about honing precision and patience, capturing gains from slight market trends.

With limited profit margins per trade, exactness in your entry and exit becomes paramount in low volatility markets. Thorough analysis and execution are essential to maximize returns from these modest movements.

The Importance of Market Analysis in Low Volatility

In the serene yet complex realm of low volatility, robust market analysis is key. Here, the absence of dramatic swings puts a premium on recognizing subtle signals, making detailed analysis not just about spotting trades but understanding market undercurrents.

Technical analysis in such markets involves keen observation of emerging patterns and trends that aren’t immediately obvious. Indicators like moving averages or Bollinger Bands become vital for detecting small momentum shifts, aiding in predicting forthcoming movements.

Yet, don’t overlook fundamental analysis, particularly for longer-term trades. In a less reactive market, knowing a company’s true value, financial health, and industry standing offers a strong basis for decisions, aiding in identifying stocks with stable or growing potential amidst volatility shifts.

Blending technical and fundamental views gives a rounded market perspective, allowing traders to align immediate tactics with broader strategies, navigating seemingly directionless markets effectively.

Staying current with market news and sentiment is also crucial in low volatility scenarios. A major news event can jolt the market, while understanding trader and investor sentiment can provide clues to future movements, even when other indicators show stability.

Adapting Trading Strategies for Low Volatility

Trading in low volatility markets necessitates a tailored approach, differing from the fast-paced volatile market strategies. Here, with minimal and sporadic price shifts, adapting your strategies to catch these subtle changes is vital.

Precision and Patience: In low volatility environments, accurate entry and exit points are critical due to smaller price movements. A calculated trading approach, emphasizing patience, prevents hasty, unprofitable decisions.

Trade Size and Frequency Adjustment: To align with smaller price variations, adjusting trade size and frequency may be necessary. While increasing trade size could offset lesser price changes, it must be balanced with risk management considerations, possibly favoring less frequent but more precise trades.

Stable Asset Focus: Targeting assets known for stability can be strategic, offering consistent, though not rapid, returns. Identifying such assets necessitates in-depth market analysis and understanding stability factors.

Options Strategies: In low volatility, options trading, such as writing options or creating spreads, can be effective, leveraging market steadiness to generate income from premium collections.

Diversification: Diversifying trading strategies helps manage risks and exploit different market opportunities, spreading exposure across various assets and market conditions.

Long-Term Positioning: Low volatility phases can be opportune for establishing or modifying long-term investments, benefiting from market stability to build positions in fundamentally strong assets.

The Psychological Aspect of Trading in Low Volatility

Trading in low volatility markets demands not just strategic shifts but also psychological adjustments. The mental and emotional game is crucial in navigating these markets, where discipline and patience reign supreme.

Cultivating Patience: Significant gain opportunities in low volatility markets are rarer and less conspicuous, necessitating heightened patience from traders to wait for the right moment.

Expectation Management: In these markets, expect slower, more consistent gains, adjusting from the high-thrill, fast-profit mindset to a more steady approach.

Frustration Handling: The slower pace and fewer chances in low volatility can frustrate traders, especially during prolonged calm periods. Managing these emotions is key to maintaining strategic focus.

Discipline Emphasis: Strict adherence to trading plans and risk management principles is essential in low volatility, preventing overtrading or riskier moves.

Focus Maintenance: With less frequent action, maintaining focus on market activities and potential opportunities becomes crucial, even in seemingly stagnant periods.

Learning and Adapting: A continuous learning mindset and adaptability to changing market conditions are vital, preparing traders to seize unexpected opportunities in low volatility markets.

Currency Pairs with Low Volatility

Trading currency pairs with low volatility requires a nuanced understanding of the forex market. Currency pairs like EUR/GBP, USD/CHF, and EUR/USD often exhibit lower volatility compared to more exotic or less liquid pairs. These pairs represent economies with large, stable markets, leading to fewer dramatic price shifts. Traders focusing on these pairs should emphasize strategic planning and analysis, as the smaller price movements necessitate precision in trade execution.

For traders eyeing currency pairs with low volatility, it’s essential to monitor economic indicators, geopolitical events, and central bank announcements that can affect these currencies. While the price swings might be smaller, informed decisions based on fundamental and technical analysis can lead to consistent profitability. Moreover, leveraging forex-specific strategies like carry trades can be more effective in such stable environments, providing opportunities for steady gains with managed risk.

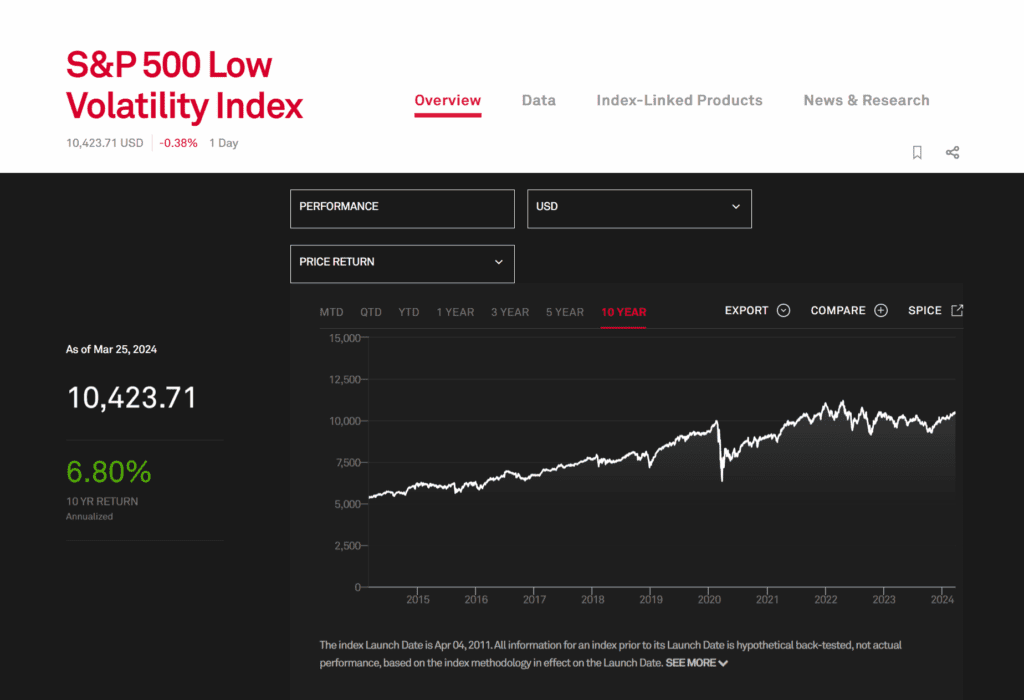

S&P 500 Low Volatility Index

The S&P 500 Low Volatility Index provides a benchmark for investors looking to gauge the performance of less volatile stocks within the broader S&P 500. This index selects constituents based on their low volatility characteristics, offering a portfolio of stocks that historically have had smaller price movements. For traders and investors focusing on stability and risk-averse strategies, this index is a key tool for informed decision-making.

Investing in or trading assets linked to the S&P 500 Low Volatility Index requires an approach that appreciates the nuances of these steadier stocks. It’s vital to conduct thorough research, understanding the sectors and companies that dominate this index, as their performance is often less affected by market swings. This knowledge, coupled with a disciplined investment strategy, can harness the index’s potential for steady, albeit potentially more modest, returns.

Incorporating an understanding of currency pairs with low volatility and the S&P 500 Low Volatility Index into your trading and investment strategies can provide a diversified approach to managing risk while seeking consistent returns. These areas, with their inherent stability, demand a well-thought-out strategy that aligns with the slower pace and subtler price movements, offering a pathway to success in the realm of low volatility trading and investing.

Conclusion

Thriving in low volatility markets is about more than mastering trading mechanics; it requires a holistic approach, blending strategy, psychological resilience, and ongoing education. Adapting to these markets means understanding their subtle dynamics, applying thorough market analysis, and tailoring strategies to match the gentler pace and smaller movements. Cultivating the right mindset, managing expectations, and maintaining discipline are key to exploiting the unique opportunities these markets present. Continuous learning and flexibility in strategy ensure long-term trading success, showcasing adaptability and resilience as crucial trading assets.