Funded Trading can be a lucrative investment opportunity, but it’s not without risks. When engaging in trading or investing, many factors can cause losses, so you need to conduct analysis and implement proper risk management.

One of the challenges you may face is a drawdown, which is a reduction in the capital caused by a series of losing trades. Drawdown is a natural part of funded trading, but it can be frustrating and even devastating if you don’t have a solid plan to control it.

In this article, we’ll explore what drawdown is, the causes it, and real-life examples. We’ll also discuss how you can control drawdown to minimize losses and improve your chances of success in funded trading.

What is Drawdown in Funded Trading

Drawdown in funded trading refers to the reduction in the value of your account balance from its highest point to its current price. It describes the percentage difference between the highest balance and the current price. This can calculate the maximum loss you have experienced during the trading period.

Drawdown is one of the essential metrics in the world of funded trading because it allows you to monitor the risk of your trading strategy. If you have a high percentage of drawdown, it can be concluded that it will lead to even more significant losses. This is where stop loss plays a role in reducing the risk of further losses.

Causes of Drawdowns in Funded Trading

Every trader or investor has experienced a drawdown at some point. Many factors can cause a it, but market volatility is one of the most significant and unavoidable factors.

External factors such as news, global economic events, and geopolitical tensions can also cause a drawdown. This is because important news or events can impact the market, causing panic and uncertainty depending on the type of news or event. Such conditions can make the market even more volatile.

Position sizing can also lead to drawdown. The larger the capital you allocate and the higher your leverage for each trade, the greater the likelihood of drawdown.

In addition, psychological factors also play an essential role and can cause drawdown if not controlled. Without realizing it, if you let fear, greed, or revenge drive your trading decisions, you may make impulsive trades that lead to drawdowns. It’s essential to maintain discipline and emotional control when trading.

Real-Life Funded Trading Drawdown Examples

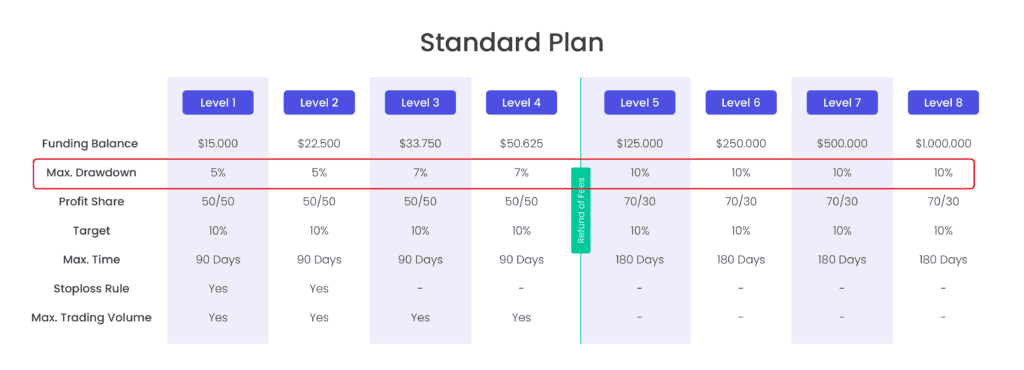

To illustrate the impact of drawdown in funded trading, let’s look at some real-life examples. Let’s say you have a FundYourFX trading account with a balance of $15,000. You enter a trade with a risk of 2% of your account balance, or $300. Unfortunately, the trade doesn’t go as expected, and you experience a loss of $600, or 4% of your account balance.

As a result of this loss, your account balance is reduced to $14,400, representing a drawdown of $600 or 4%. At this point, you have two options: if you believe that the price will eventually recover, you could continue trading with the remaining account balance. Alternatively, if you’re worried that the drawdown will increase, you could close the position and reassess your strategy and risk management plan.

How to Control Drawdown in Funded Trading

Controlling drawdown in funded trading is crucial to minimize losses and increase your chances of success. A solid trading plan is one of the most effective ways to control it. By having a trading plan, you will become more organized and avoid impulsive decisions that can affect your assets.

Using stop-loss orders is also effective in controlling drawdown. This can limit the loss you experience after reaching your set price limit. Diversifying your investments is also another excellent way to control it. Do not just trade in one security, but try others. By diversifying, you can reduce the drawdown value while also covering drawdowns that occur in one security with profits you gain from another.

Make sure you also have good risk management to minimize significant losses. And equally important, you must be disciplined, such as always following your trading plan, which includes when to enter and exit trades and how much to allocate for each open trade position. Controlling drawdown is crucial for maintaining profitability and minimizing risk, so you can keep it under control and improve your chances of success.

In Conclusion

Drawdown is a natural part of funded trading that every trader or investor will experience at some point. The causes can range from market volatility, external factors such as news and economic events, position sizing, and psychological factors such as fear and greed.

To minimize losses and increase your chances of success, it’s crucial to control drawdown by implementing proper risk management and having a solid trading plan. Stop loss orders, diversifying your investments, and maintain discipline are all effective ways to control drawdown. Doing so can keep it under control and improve your profitability.