Introduction: Understanding the Importance of Risk Management in Trading

Trading may be interesting and even successful if you can focus, do your research, and keep your emotions under control. Even the best traders must implement risk management strategies to keep losses from spiraling out of hand. Risk management can aid in preventing a trader from losing all of the money in the account. Both new and experienced traders alike should use risk management.

What is Risk Management and Why is it Important?

Risk management is a process through which investors identify, quantify, and evaluate the risk for a variety of trading actions before deciding whether to accept or reduce it. Traders must determine their individual level of risk tolerance and investment objectives, then take appropriate action.

Traders need to put the right “fuel” on the fire in order to make a profit. Managing risks is the “fuel” necessary for success. Let’s first think about why risk management is so crucial while trading and investing before we examine strategies to limit your losses that can be utilized to manage risk on the account.

Strategies to Limit Your Losses:

Set Clear Rules to Keep Emotions in Check

Having a strict trading strategy that outlines when, how, and where you initiate, manage, and exit deals are essential. A risk management strategy is essential for any successful trading method since it helps minimize unnecessary and disruptive social and psychological impacts.

Establish Reasonable Goals and Stick to Them

Set reasonable goals and stick to them. Calculate the price at which you can afford to acquire and sell. Do not proceed if the trade doesn’t really fit your pre-established conditions.

Diversify and Hedge Your Portfolio

Portfolio diversification is a strategy for reducing the risk of investing or trading by spreading your capital over multiple asset types. American economist Harry Markowitz first introduced this idea of modern portfolio theory in his 1952 paper “Portfolio Selection,” which has since been extensively adopted.

Portfolio holdings can be diversified between and within asset classes by investing in both domestic and international markets. Diversifying your holdings among a number of commodities will allow you to at least somewhat offset the losses from one of them.

Understand the Market

To detect trading risks, one must first understand the many market dynamics. These variables can be economic factors, such as trade wars or central bank interest rate choices. You must take those economic elements into account when making trading decisions that could have an impact on your assets.

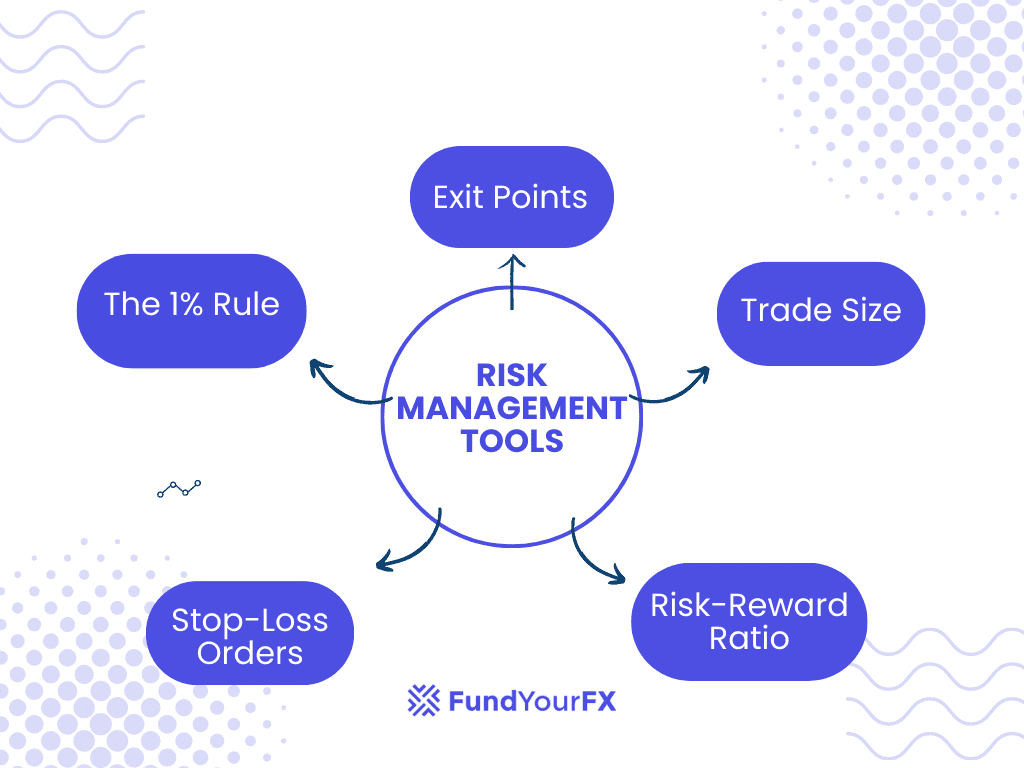

Utilize Risk Management Tools to Your Advantage

Key features of risk management tools include trade size, Stop-Loss Orders, The 1% Rule, Exit Points, and appropriate risk-reward ratios. Let’s examine each one individually.

Stop-Loss Orders: How to Use Them Effectively

Stop Loss is a market order that limits potential losses. To have your trade close automatically, all you have to do is select a rate in advance. Stop Loss is a fantastic tool that can help you stop excessive losses, and it’s especially important for traders who manage several deals and can’t continuously monitor every rate.

The most generally used method of establishing these levels is via moving averages because they are simple to compute and closely monitored by the market. The 5-, 9-, 20-, 50-, 100-, and 200-day averages are significant moving averages. Another excellent spot to post stop-loss or take-profit levels is on support or resistance trend lines. They can be created by linking prior highs or lows that were placed on a substantial, above-average volume.

The 1% Rule: Why You Shouldn’t Risk More Than You Can Afford to Lose

The 1% Rule is a strategy that many traders use and recommend. According to this general rule of thumb, you shouldn’t trade more than 1% of your cash or trading account in a single trade. Hence, if you have $10,000 in your trading account, you shouldn’t have more than $100 traded in any one instrument. By doing this, you can experience a run of losses—always a danger given the random distribution of results—while minimizing the harm to your portfolio.

Exit Points: When to Cut Your Losses

Finding the right exit points is essential for limiting potential losses and taking profits before those possibilities pass. When faced with scenarios that could result in losses or missed profit possibilities, you should let the moment at which you will sell take the emotion out of trading.

A crucial price level should be chosen as the exit point. This occurs frequently at a fundamental turning point for long-term traders, like the company’s yearly goal. This is frequently placed at technical positions for short-term traders, such as pivot points, specific Fibonacci levels, or others.

Trade Size: How to Determine the Right Position Size

Divide the amount at risk or account risk limit by your trade risk to get the optimum position size for a trade. A simple mathematical formula determines position size, which aids in risk management and returns optimization. The selection of position size just requires two steps:

- Step 1 – Determine Account Risk

It is recommended that traders only risk 1% or less of their trading capital, regardless of the value of their account.

- Step 2 – Calculate trade risk

You must establish a stop loss level in order to calculate position size. An order has been put in at a logical point that is beyond the regular market movement range. Here’s the formula:

Trading Risk = Entry Price – Stop Loss.

Risk-Reward Ratio: How to Assess Your Potential Profit and Loss

The Risk-Reward Ratio enables traders to weigh the risk involved in reaching expected profits on investment. You may figure it out by dividing the amount the trader will lose by the anticipated profit when the position is closed.

Consider your take-profit and stop-loss orders first when you see an entry signal. Measure the Risk-Reward Ratio after deciding on fair price points for your orders. Skip the trade if it doesn’t meet your needs. To increase the reward-risk ratio, don’t try to make your take profit order larger or your stop loss order smaller.

Conclusion

The first step in trading risk management is assessing your trading strategy’s win-loss ratio and the average size of your wins and losses. Knowing these figures and how they affect long-term performance can put you on the path to profitable trading.

A solid risk management approach can help to protect money, prevent losses, and optimize profits. Although there is no surefire way to stop losses, traders can gain a big advantage by using a well-thought-out risk management approach. As a result, it is essential to adopt an effective trading risk management approach.