Calculating the right lot size in Forex trading is vital for effective risk management. It’s important to consider your account balance and the percentage you’re willing to risk on each trade, typically between 1% and 2%. Understanding pip value and the distance of your stop-loss can help you find the correct lot size. Let’s break down the steps for this calculation and highlight its significance in your trading approach.

What Is a Lot in Forex?

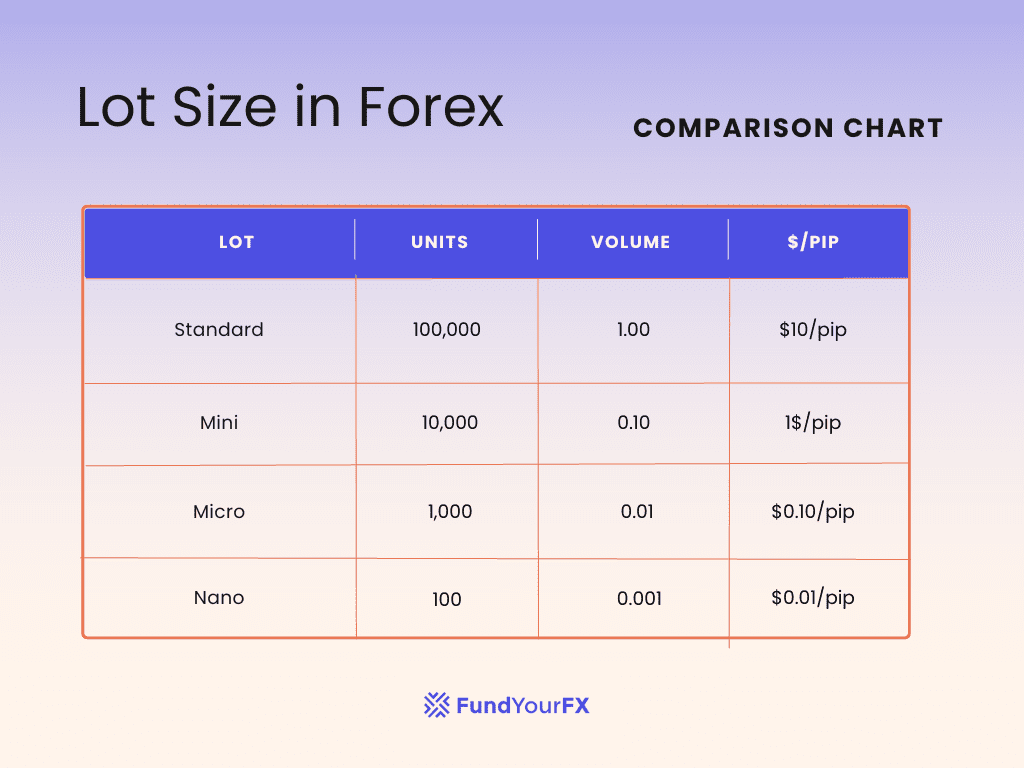

In Forex trading, grasping the concept of a lot is vital for managing your trades effectively. A lot acts as a standardized unit that defines the size of your trades. For instance, one standard lot is equivalent to 100,000 units of the base currency, enabling traders to take larger positions in the market.

In addition to standard lots, there are smaller sizes available, including mini lots (10,000 units), micro lots (1,000 units), and nano lots (100 units). Selecting the appropriate lot size is crucial as it directly influences your risk exposure. Larger lots can magnify both potential profits and losses.

Forex brokers usually offer a range of lot sizes to cater to different trading strategies and account balances. Therefore, it’s essential to choose a lot size that corresponds with your risk tolerance and trading style.

Why Lot Size Matters

Choosing the right lot size is not just about maximizing profit; it’s about protecting your capital and ensuring longevity in trading. A well-calculated lot size aligns with your risk tolerance and trading strategy, ultimately contributing to more consistent results.

In Forex trading, understanding how to calculate your lot size effectively can lead to better risk management and a more disciplined trading approach. Always remember that the goal is to protect your investments while seeking growth.

Types of Lot Size in Forex

In forex trading, lot sizes refer to the quantity of currency units you are trading. Understanding different lot sizes is crucial for managing risk and capital effectively. Here are the main types of lot sizes in forex:

Standard Lot:

- A standard lot is equivalent to 100,000 units of the base currency in a forex pair.

- Trading one standard lot means you are controlling $100,000 worth of the currency.

- This lot size is typically used by experienced traders due to the significant amount of capital involved and the higher risk/reward potential.

Mini Lot:

- A mini lot is equal to 10,000 units of the base currency.

- Trading one mini lot means you are controlling $10,000 worth of the currency.

- Mini lots are a popular choice for retail traders as they allow for smaller trades and lower risk compared to standard lots.

Micro Lot:

- A micro lot is equivalent to 1,000 units of the base currency.

- Trading one micro lot means you are controlling $1,000 worth of the currency.

- This lot size is ideal for beginners or those who wish to trade with smaller amounts of capital.

Nano Lot:

- A nano lot is equal to 100 units of the base currency.

- Trading one nano lot means you are controlling $100 worth of the currency.

- This lot size is less common but is offered by some brokers for traders who want to minimize their risk even further.

How to Calculate Lot Size in Forex?

Calculating your lot size in forex is a fundamental aspect of effective trading. It involves understanding key elements like risk management, pip value, and your stop loss.

Steps to Calculate Your Lot Size

- Determine Your Account Balance: Know how much money you have available for trading.

- Set Your Risk Percentage: Decide what percentage of your account you’re willing to risk on a single trade—1% to 2% is a common range

- Calculate Your Dollar Risk: Multiply your account balance by your risk percentage. For example, if you have a $10,000 account and decide to risk 1%, your dollar risk is $100.

- Assess the Pip Value: Understand how much each pip is worth in your specific currency pair. For a standard lot, each pip is typically worth $10, while for a mini lot, it’s $1 and for a micro lot, it’s $0.10.

- Determine Stop Loss Distance: Decide how many pips you are willing to risk based on your strategy.

- Calculate the Lot Size: Use the formula:

[text{Lot Size} = frac{text{Dollar Risk}}{text{Pip Value} times text{Stop Loss Distance}}]

This will help you arrive at the optimal lot size for your trade.

Risk Management

Effectively managing risk is a vital component of a successful forex trading strategy. To determine your lot size, start by assessing the amount of capital you’re willing to risk on a single trade. A common recommendation is to limit your risk to 1-2% of your total investment. For example, if you have a trading account with $10,000 and choose to risk 1%, your maximum potential loss would be $100.

Next, you need to calculate the pip value and the distance to your stop loss in pips. Use the formula:

Lot Size = (Account Risk in $) / (Risk per Pip Value)

This will help you ascertain the appropriate lot size for your trades. It’s wise to adjust your calculations based on market fluctuations and your comfort level with risk. By doing so, you’ll create a more balanced and effective trading strategy.

As you approach your trading decisions, keeping your risk management plan in mind will help you stay focused and make informed choices.

Calculating Pip Value

Calculating pip value is vital for successful forex trading, as it affects your risk management and how you size your positions.

To find the pip value, you can use the formula: (size of a pip) / (exchange rate) × (lot size). For currency pairs where the U.S. dollar is the quoted currency, such as EUR/USD, the pip value is consistently set at 0.0001 for a standard lot of 100,000 units.

In contrast, for pairs that don’t have the U.S. dollar as the base currency, a different method is necessary. For instance, with USD/JPY at an exchange rate of 119.80, the pip value for a standard lot comes out to about $8.34.

Determining Stop Loss

Setting a stop loss is a vital part of managing your trading risk and safeguarding your capital. A stop loss determines the price level at which you’ll exit a losing trade. This can be based on technical analysis or a certain number of pips away from your entry point

To figure out your lot size while considering a stop loss, start by deciding on your risk tolerance, which is usually between 1-2% of your total account equity.

Next, calculate the difference in pips between your entry price and your stop loss. You can use the formula:

Lot Size = (Account Risk in $) / (Stop Loss in pips × Pip Value)

Keep in mind that a tighter stop loss can allow for a larger lot size, while a wider stop loss will typically reduce it. For more ease in calculations, consider using a position size calculator.

Example of Lot Size Calculation in Forex

To calculate lot size in forex trading, it’s important to follow a clear method.

For instance, if your account balance stands at $10,000 and you decide to risk 2%, that would equal $200.

Suppose your stop loss is set at 50 pips, and the pip value is $10.

You can determine the lot size using this formula:

Lot Size = (Account Balance × Risk Percentage) / (Pip Risk × Pip Value)

Substituting the figures into the formula, it becomes:

Lot Size = ($10,000 × 0.02) / (50 × $10)

This calculation gives you a lot size of 0.4 lots.

Accurately determining your lot size is key for effective risk management, helping to safeguard your trading capital.

Maximum Lot Size in Forex

In forex trading, knowing the maximum lot size you can trade is essential for effective risk management. This limit is set by your broker and can differ based on several factors, such as your account type, available leverage, and any applicable regulations.

Here’s a quick breakdown of lot sizes:

- Standard lots are usually 100,000 units,

- Mini lots represent 10,000 units,

- Micro lots consist of 1,000 units, and

- Nano lots are 100 units each.

Brokers implement these limits to help manage risk exposure and ensure compliance with margin requirements.

Before deciding on your maximum lot size, assess your account equity and the margin required for your trades. This evaluation helps you prevent situations like margin calls, which occur when your account balance falls below the required level to maintain your positions.

Always check your broker’s specifications to understand the maximum allowable lot sizes for your specific trading account. This knowledge is vital for making informed trading decisions and managing your investments wisely.

What Determines the Lot Size in Forex

When deciding on your lot size in Forex trading, you need to consider three main factors: your account balance, the percentage of your account you’re willing to risk, and the distance to your stop loss.

Your account balance is the starting point, as it dictates how much money you can afford to risk in your trades. For example, if you have a $10,000 account and decide to risk 1% on a single trade, you’d be willing to risk $100.

Next, the percentage of your account at risk plays a significant role in your trading strategy. Many traders choose to risk between 1-2% of their account on each trade. This approach helps in managing potential losses while allowing for growth in your trading capital.

Lastly, the distance to your stop loss is crucial. The further away your stop loss is set, the smaller your position size should be to keep your risk within your predetermined limits. For instance, if you set a stop loss 50 pips away on a trade, you need to adjust your lot size accordingly to ensure that you don’t exceed your risk tolerance.

Conclusion

Calculating lot size in Forex plays a key role in managing your trading risk. To determine the appropriate lot size for your trades, assess your account balance and understand your risk tolerance. Use the specified formula to find a suitable lot size, taking into account pip values and the distance to your stop loss. Being mindful of these factors is vital for protecting your capital and refining your trading approach. Always engage in trading responsibly and stay updated on market trends.