Learning advanced trading strategies gives you more tools to improve your results and control risk in the financial markets. Some common methods include counter trading, where traders look for points where the price may change direction, and swap trading, which takes advantage of interest rate differences between currencies. By understanding arbitrage, traders can spot and act on price differences across exchanges or markets.

As you gain more experience, it’s helpful to add reliable day trading techniques and risk management plans to your approach. For example, using stop-loss orders and position sizing can help protect your capital during unexpected market moves. Staying updated with economic news and regularly reviewing your trades can also help you adjust to changing market conditions.

A seasoned trader once said, “Success in trading comes not from predicting every move, but from managing risk and staying disciplined over time.” The key is to combine practical strategies with careful planning so you can aim for steady growth while keeping losses in check.

Top Advanced Forex Trading Strategies You Should Know

Learning advanced forex trading strategies can help you make more informed decisions and potentially improve your results. One effective method is using counter trading techniques. This approach involves going against the current trend by spotting candlestick patterns that suggest a possible reversal. For example, if you notice a hammer or engulfing pattern after a long downward move, it could signal a shift in momentum. Incorporating risk management into your counter trading is vital, as it can help protect your account from unexpected reversals.

Another strategy is taking advantage of swap trading benefits. By keeping positions open overnight, you may earn or pay interest depending on the interest rate difference between the two currencies in your pair. For instance, if you hold a currency with a higher interest rate against one with a lower rate, you could earn what’s known as a positive swap.

Triangulation methods offer another way to seek profit. This involves moving funds through a third currency to benefit from price differences in the bid-ask spreads. For example, if you see an opportunity to convert USD to EUR, then EUR to GBP, and finally GBP back to USD at more favorable rates, you might lock in small gains with each trade.

Arbitrage opportunities are also worth considering, especially during times of market volatility. These occur when you find price differences for the same currency pair across different brokers or markets. By quickly buying at a lower price and selling at a higher price elsewhere, you can take advantage of short-lived discrepancies. However, this demands fast execution and awareness of transaction costs.

Finally, applying position ratio analysis can help you read overall market sentiment. By looking at the proportion of traders who are long versus those who are short, you can get a sense of where the crowd is leaning. If most traders are long and the market starts to turn, it might be a sign to consider short positions.

A strong understanding of leverage in forex trading is essential when applying advanced strategies, as it allows you to control larger positions with smaller capital but also increases your exposure to risk.

These strategies can add more structure and insight to your trading approach. Always remember to test each method thoroughly and adjust your risk management according to your personal tolerance and market conditions.

Developing a Forex Trading Strategy

A strong Forex trading strategy can help you make better decisions and improve your chances of earning steady profits. Focusing on a few key areas can make your approach more effective and reliable. Here’s what to keep in mind:

Understanding Market Trends

Spotting the direction of the market is a basic step for any trader. Tools like moving averages, price action patterns, and support or resistance levels can help you recognize if a currency pair is likely to go up or down.

For example, when the 50-day moving average crosses above the 200-day moving average, traders often see this as a sign of a longer-term upward trend.

Combining Technical Indicators for Better Signals

Relying on a single indicator often leads to false signals. It’s usually more effective to use several indicators together.

For instance, you might use Bollinger Bands to check for overbought or oversold conditions and combine them with a stochastic oscillator to confirm if a trend reversal is likely. By looking at different types of indicators, you can filter out weak signals and focus on high-probability trades.

Assessing Market Sentiment

Understanding how other traders are positioned gives valuable insight into possible price movements. Many trading platforms share data about the ratio of long and short positions in major currency pairs.

If most traders are betting in one direction, prices may soon move the other way as positions get closed out. Staying aware of this can help you avoid crowded trades.

Testing Strategies with Historical Data

Before using any strategy in real-time, it’s smart to see how it would have performed in the past. Backtesting involves running your strategy through past market data to find out if your rules would have worked.

For example, setting up your charts in MetaTrader 4 or TradingView allows you to check the results of your approach over several years. This can help you spot weaknesses and make improvements before risking real money.

A key part of improvement is understanding how volume analysis can help you interpret market strength and confirm the validity of your trading signals.

Taking these steps when developing your Forex trading plan can give you a clearer perspective and increase your chances of long-term success. The more you refine your approach, the more confident and prepared you’ll feel in fast-moving markets.

Advanced Trading Concepts

Advanced trading strategies go beyond the basics by introducing tools and methods that help traders make more informed decisions. Quantitative analysis is a key part of this approach. By examining large sets of data, traders can spot patterns and opportunities that mightn’t be obvious through traditional methods. For example, many professional traders use statistical models to predict how a stock might react after an earnings report. In addition to these techniques, understanding your risk-to-reward ratio before entering a trade is crucial for ensuring long-term profitability.

Understanding how market sentiment works is also important. The emotions and behaviors of other traders often drive sudden changes in price. This is why keeping an eye on sentiment indicators, such as the put/call ratio or the volatility index (VIX), can help you anticipate big moves in the market.

Volatility trading offers another way to respond to fast-changing prices. During major news events—like central bank announcements or political developments—markets can swing sharply. Some traders use options or specialized exchange-traded funds (ETFs) to try to profit from these swings.

Using automated trading systems is becoming more common. These systems execute trades based on pre-set rules, which helps reduce the impact of emotions on trading decisions. For example, platforms like MetaTrader or TradeStation allow users to set up automated strategies that buy or sell when certain conditions are met.

Mastering these advanced concepts can help traders manage risk better and adjust to changing market conditions. The more you understand about data analysis, market psychology, volatility, and automation, the better prepared you’ll be to face the challenges of modern trading. One of the most essential skills is emotional control, which helps traders avoid impulsive decisions and stick to their strategies even when markets are volatile.

If you’re looking to apply these concepts, consider exploring popular market analysis tools like TradingView for data visualization, or experiment with paper trading on platforms like Thinkorswim to test strategies before risking real money.

Day Trading Strategies

Day trading is all about buying and selling stocks or other assets within the same trading day. The goal is to take advantage of small price changes, often using quick decisions and a careful eye on the market. Here are some practical strategies that can help you manage your trades more effectively:

Momentum Trading: Riding the Wave

Momentum trading focuses on stocks that are moving sharply in one direction—usually upward due to news, earnings reports, or strong trading activity. For example, if a tech company announces better-than-expected profits, its stock might climb quickly.

Traders often look for increased trading volume and price spikes as signals to enter these trades, aiming to catch the trend before it slows.

Scalping: Quick In-and-Out Profits

Scalping is a strategy that relies on making many small trades throughout the day. Instead of holding a position for hours, scalpers might buy and sell within minutes or even seconds.

The idea is to collect small gains that can add up over time. This approach works best in markets with lots of activity and tight bid-ask spreads, such as major stocks or currency pairs.

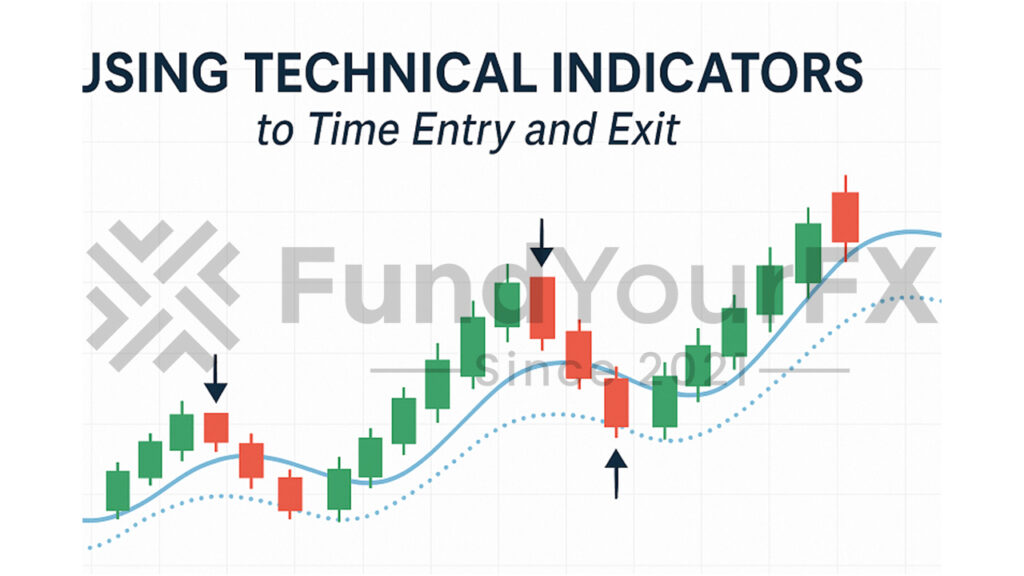

Using Technical Indicators to Time Entry and Exit

Technical analysis tools, like moving averages and Bollinger Bands, help traders spot opportunities to buy or sell. For instance, when a stock price crosses above its 50-day moving average, it might signal an upward trend.

Bollinger Bands can show if a stock is overbought or oversold, helping traders decide when to enter or exit a position. These tools are widely used because they help reduce guesswork.

Market Trend Analysis: Making Informed Decisions

Understanding the overall direction of the market can improve your chances of success. For example, if the S&P 500 is trending upward, it may be safer to focus on buying rather than shorting stocks.

Tracking trends can also help you set better stop-loss orders, which protect your profits and limit your losses in case the market moves against you.

These strategies aren’t one-size-fits-all, so it’s smart to try different methods and see what works best for your personality and risk tolerance.

Always use a demo account to practice before risking real money, and keep up with the latest news, as market conditions can change quickly.

Additionally, practicing with virtual demo accounts allows traders to simulate real market conditions and refine their strategies without financial risk.

Risk Management Terms

Managing risk is a fundamental part of trading. It helps safeguard your investment and keeps losses under control. One of the first steps is to understand your own risk tolerance. This means knowing how much money you’re comfortable risking on a single trade, so you don’t end up taking losses you can’t recover from.

Position Sizing and Capital Allocation

Position sizing is about deciding how much of your trading account to put into each trade. For example, many traders risk only 1-2% of their total account on any single trade to avoid large losses during a losing streak. This approach helps protect your overall capital, especially in volatile markets.

Stop Loss Orders and Profit Targets

Stop loss orders are tools that automatically close your trade if the price moves against you by a set amount. This helps you stick to your plan and avoid bigger losses than you intended.

On the other hand, setting profit targets means choosing a price level where you’ll take your gains and exit the trade. Doing this helps you make consistent profits and avoid the temptation to hold onto trades for too long, which can lead to missed opportunities or bigger losses.

Regular Strategy Reviews

It’s important to review your trading strategies from time to time. This practice allows you to identify what’s working, spot mistakes, and adjust your plan as needed.

For example, if you notice that your stop loss levels are too tight and you’re getting stopped out too often, you might adjust your strategy to give trades a little more room.

By focusing on these key aspects of risk management—knowing your risk tolerance, using proper position sizing, setting stop losses and profit targets, and reviewing your strategies—you can build a more stable approach to trading.

Utilizing stop-loss orders is a critical component of any risk management plan, as they automate trade closure and limit emotional decision-making during volatile market downturns.

This helps you stay in the game longer and gives you a better shot at long-term success.

Conclusion

Managing the ups and downs of the financial markets calls for a deeper understanding of trading strategies. Techniques such as counter trading, swap trading, and arbitrage can help traders make the most of market fluctuations. For example, arbitrage involves taking advantage of price differences for the same asset across different markets, which can offer low-risk profits when executed quickly. Swap trading lets traders benefit from interest rate differences between currencies, while counter trading aims to capitalize on short-term reversals.

Day trading is another approach that focuses on making quick trades within the same day to profit from small price movements. This method requires close attention to market trends, quick decision-making, and a firm grasp of technical analysis.

Success in trading is not just about making the right moves—managing risk is just as important. Setting clear stop-loss levels, using position sizing, and staying updated with financial news can help protect your portfolio from sudden market changes.