Trading the news is often difficult and not for everyone, but the resulting volatility can present several trading possibilities. In this post, we will go through the advantages of news trading in today’s markets in great depth.

What is news trading?

A news trading strategy involves trading based on news and market expectations both before and after news releases. The bulk of markets is affected by global economic changes.

The release of significant economic data, remarks made by government leaders, and happenings in the wider geopolitical sphere are all important for traders to keep an eye on. This is due to the fact that this information typically reflects the strength of a certain economy and can forecast the direction in which an asset will move in the future. Traders may find it helpful to predict short-term (intraday or multiday) market swings or breakouts if they have a solid understanding of economic news events and their potential market impact, for example. In highly volatile markets, a trading strategy based on news can be quite profitable.

Why you should trade the news?

The news is an essential component of trading since it has the power to impact the market. When news breaks, especially critical news everyone is watching, you can almost always expect significant movement. The fact that you know the market will most likely move, makes this an opportunity worth pursuing. Just make sure you’re on the right side of the move, whether it’s up or down.

News trading may be exciting, but it can also be risky, so never underestimate the importance of a story. If you are inexperienced, avoid trading the news, and if you do, always use risk management.

Should you just rely on the news?

No, you should not just rely on the news alone. Because of the overlapping areas, combining fundamental and technical analysis is advantageous. Trading news events can explain market swings and they reflect in chart movements.

Even if you favor technical analysis, keeping one eye on significant news developments is important. Many traders use fundamental analysis because it reveals the macroeconomic narrative. Because every asset is dependent on underlying economic performance, traders who follow fundamental research and trading news events are betting on the asset’s strength or weakness concerning national economic performance.

What are the categories of news to trade?

Market news is divided into two categories: scheduled and unscheduled.

Scheduled Announcements

Scheduled announcements are news releases that traders and investors know about ahead of time. They may not know the specifics of the announcement, but they will know when it is scheduled to take place.

Economic data (such as interest rates, retail sales, inflation, and employment reports), corporate earnings, and election updates are among the important planned news items that traders will monitor.

Unscheduled Announcements

Unscheduled news comes unexpectedly and may catch traders off guard. Players in the market will change their trades or abandon the market in response, resulting in a large swing or trend reversal. Unplanned events, known as black swans, can occur in rare instances.

Alterations of a significant nature in the supply and demand conditions on a worldwide scale are another element that must be taken into consideration. Because they have the potential to be significant contributors to overall market movement, traders pay close attention to brent and crude oil in particular when reading the business news.

How to trade the news?

Before you can establish this strategy, you must first determine which news events are even worth trading. You are trading the news because of its potential to create volatility in the short term, so you would logically want to trade only news that has the most market-moving potential.

Price movement and volatility are typically driven by news that includes:

- Fiscal policy

- Monetary policy

- Unexpected economic data releases

- Tweets from international leaders

Knowing about forthcoming significant event risks will help you avoid being on the wrong side of the market.

How to identify important news events?

You can use an economic calendar. The Economic Calendar covers major events and economic data published by countries. Event risk is defined as anything that has the potential to affect markets but cannot be predicted. You may use an economic calendar to keep track of major news events and economic data releases that may influence the financial markets and your trade.

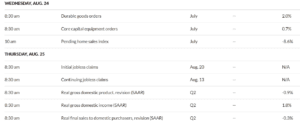

If you spend some time looking over the Economic Calendar, you’ll see that the most important events generally involve changes in interest rates, inflation, and economic growth, such as retail sales, manufacturing, and consumer confidence. An example below is the Marketwatch economic calendar for the United States.

This is why it’s important to keep updated and understand what the market is concentrating on right now.

Why you should focus on markets relating to the U.S.?

Even if the stature of the United States is weakened as a result of setbacks, imbalances, and vulnerabilities, the strength and influence of the United States dollar will not be equaled at any time in the near future. The economy of the United States of America is still the greatest in the world, and the dollar continues to be the reserve currency used around the globe. Because of this, the United States dollar is involved in practically all currency transactions; hence, news and data from the United States are extremely important to follow.

Where can I trade the news?

In FundYourFX, you may trade the news, as well as use your own EAs, hedge positions, and leave trades open over the weekend and overnight. FundYourFX’s flexible trading rules are the ideal combination for you to begin trading news with us. If you want to trade forex news, the 1:100 leverage is among the best in the market.

In Summary

Trading on the news is already one of the most popular financial market strategies. In general, news trading works in any market. This is because global news events may have a major influence on a variety of trading assets, including Forex pairs, stocks, commodities, and futures. It is necessary to do as much initial market research as possible and to understand how to respond fast to global news occurrences.