The Evaluation Challenge: Does it Set You Up for Failure?

Introduction

Prop firms use various methods to evaluate traders before they can trade with the firm’s capital. One of the most common methods is the evaluation challenge, which sets traders a specific profit target within a certain time frame while adhering to the firm’s risk management guidelines. However, many traders argue that the evaluation challenge is simply a way for prop firms to make money off of failed traders and that the challenges are intentionally made difficult to achieve. In this article, we will explore the evaluation challenge in more detail and discuss whether or not it truly sets traders up for failure. While evaluation is important for prop firms, we will also consider whether there are better and more effective methods for evaluating traders.

Why the Evaluation Challenge Sets You Up for Failure

Prop trading firms often use the evaluation challenge to evaluate and fund traders. However, this method may not always be the best way for traders to succeed. In fact, the evaluation challenge could potentially set traders up for failure.

How the evaluation challenge works

The evaluation challenge is when a prop trading firm provides a set of rules and guidelines for traders to follow. The trader is then given a certain amount of time to trade using the firm’s capital. If the trader can meet the profit target while following the rules and guidelines, they will pass the challenge and receive funding from the firm.

Common challenges and mistakes traders make during the evaluation process

Unfortunately, many traders face difficulties during the evaluation process, which can lead to failure. Some common challenges include unrealistic profit targets, poor risk management, overtrading, and revenge trading. Additionally, ignoring the rules and guidelines set by the firm can also lead to disqualification.

Unrealistic profit targets and risk management

Prop firms often set obscenely high-profit shares, sometimes as high as 90% or even 100% profit share, to lure traders in. While it may seem like an attractive opportunity, the reality is that trading is already a difficult endeavor, with only around 10% of traders succeeding in the long run. Once traders are lured for the profit share, they would likely fail because unrealistic profit targets can lead to traders taking too much risk and making poor decisions.

Overtrading and revenge trading

Overtrading and revenge trading can also lead to failure during the evaluation process. Overtrading occurs when a trader takes too many positions, exceeding risk limits. Revenge trading, on the other hand, occurs when a trader takes positions out of frustration or anger after experiencing losses. Both of these behaviors can lead to poor decision-making and increased risk.

Ignoring the rules and guidelines set by the firm

Ignoring the rules and guidelines set by the firm is another common mistake traders make during the evaluation process. This can include things like violating risk limits or trading outside of allowed hours. Ignoring these rules can lead to disqualification from the evaluation process and potentially losing the opportunity for funding.

How these challenges lead to failure in the evaluation process

These challenges can lead to failure during the evaluation process and prevent traders from receiving funding from the firm. Not only does this result in the loss of the opportunity for funding, but it can also be discouraging for traders who put in a lot of effort during the evaluation process.

How the evaluation challenge may not accurately represent a trader’s abilities

Another issue with the evaluation challenge is that it may not accurately represent a trader’s abilities. Factors such as market conditions during the evaluation period, personal circumstances, and the trader’s emotional state can all impact their performance during the evaluation process.

Alternatives to the evaluation challenge that may be more effective for success

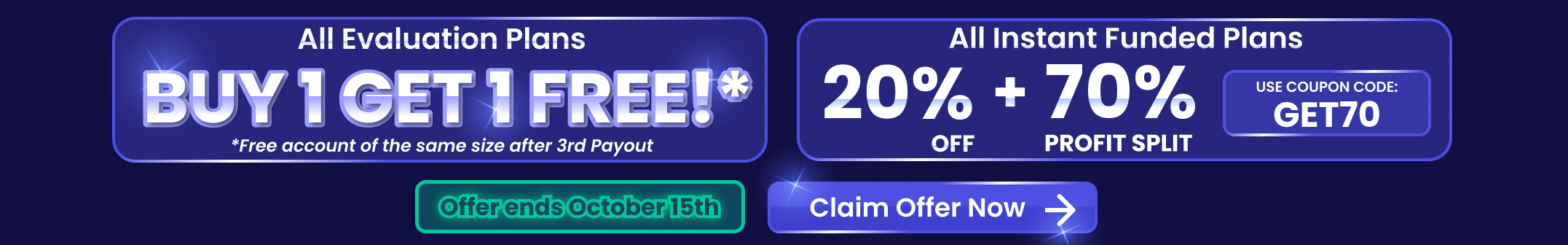

Given the challenges associated with the evaluation challenge, traders may consider alternative methods for funding. One alternative is an instant funding prop firm, which provides traders with immediate access to funding without needing an evaluation challenge. While these firms may offer a lower but realistic profit share, they can be a more straightforward and less stressful option for traders.

However, traders should also be wary of challenge prop firms that may focus more on making money from failed challenges than supporting successful traders. According to FTMO, only 8% of traders pass their evaluation challenge, indicating that these firms may be profiting largely from failed traders. Traders should research and carefully consider their options before committing to any particular prop trading firm.

Why Prop Firms Use the Evaluation Challenge

Proprietary trading firms use the evaluation challenge to assess a trader’s ability to trade with the firm’s capital. By setting a profit target and time frame, the firm can evaluate a trader’s performance under specific market conditions and risk management guidelines.

One of the key benefits of using the evaluation challenge is that it allows prop firms to identify traders who have the potential to generate consistent profits and manage risk effectively. This helps the firm to minimize the risk of losses and maximize profits. Additionally, the evaluation challenge can be a cost-effective way for firms to recruit new traders, as it avoids the need for extensive training programs.

However, the evaluation challenge also has its drawbacks. Some traders argue that the challenge is intentionally made difficult, with unrealistic profit targets or tight time frames, to maximize the number of traders who fail and pay for a new evaluation. This has led to some criticism of prop firms and the evaluation process.

Some prop firms have begun offering instant funding programs to address these concerns and provide a more supportive environment for traders. These programs provide traders with immediate access to the firm’s capital without needing an evaluation challenge. While instant funding programs may involve more stringent risk management requirements, they allow traders to trade with real capital and generate profits without passing a specific challenge.

While the evaluation challenge remains a popular evaluation method for prop trading firms, instant funding programs offer a viable alternative for traders who want to avoid the challenge and start trading immediately. Prop firms can better support traders and improve their overall profitability by considering alternative methods and improving the evaluation process.

The Difference Between Instant Funding vs Evaluation Prop Firms

One of the goals of instant funding prop firms is to attract as many traders as possible to increase their chances of finding the best and most profitable traders. These firms make money by taking a percentage of successful traders’ profits. In contrast, the evaluation challenge also aims to find profitable traders but may focus more on generating revenue from traders who fail the challenge.

One reason is that prop trading firms charge a fee to join the evaluation challenge, and if a trader fails, they do not get their fee refunded. This is a disadvantage for traders, as they essentially pay for the opportunity to be evaluated, with no guarantee of success. However, from the perspective of the firm, this approach can be profitable, as they can generate income from a large number of traders who fail the challenge.

Instant funding prop firms, on the other hand, offer a more direct path to funding for successful traders, without the need for an evaluation process. This approach can be more attractive to traders, as they can start trading with real money immediately, rather than going through an evaluation period.

The Impact of the Evaluation Challenge on Traders

The trading world is constantly evaluated and assessed, and traders continuously strive to improve their skills and performance to succeed in the market. However, with the high stakes and intense pressure that come with trading, the evaluation challenge can significantly impact traders psychologically and emotionally.

One of the most significant ways the evaluation challenge affects traders is by impacting their motivation and confidence. The pressure to perform and meet evaluation criteria can be overwhelming, causing traders to doubt their abilities and question whether they are capable of achieving success in the market. This can lead to decreased motivation and a lack of confidence, ultimately impacting trading performance.

To maintain a positive mindset during the evaluation process, traders should focus on developing a growth mindset and recognizing that failure is an opportunity for learning and growth. They should also prioritize self-care and reduce stress and anxiety, such as meditation, exercise, and seeking support from friends and family.

If a trader fails the evaluation challenge, it can devastate their confidence and motivation. However, it is important to remember that failure is a natural part of the learning process and that successful traders often experience many setbacks before achieving success. Traders should take the time to reflect on their performance, identify areas for improvement, and develop a plan for moving forward. This might include seeking additional training or education, working with a mentor or coach, or adjusting their trading strategy.

Overall, the evaluation challenge is a significant aspect of trading that can profoundly impact traders. By maintaining a positive mindset and focusing on growth and learning, traders can overcome evaluation challenges and ultimately achieve success in the market.

Alternatives to the Evaluation Challenge

Alternative methods for evaluating traders have gained popularity as a way to assess a trader’s potential for success in the market. One such alternative is instant funding. Unlike the traditional evaluation challenge, instant funding prop firms provide traders with immediate access to trading capital without any initial evaluation process.

This approach allows traders to start trading with real capital and prove their profitability without going through the evaluation process. This can be a great opportunity for traders who want to avoid the pressure and stress of the evaluation challenge.

One benefit of instant funding is that traders can start trading immediately and begin earning profits from day one. This can be a huge morale booster, as traders do not have to wait for the results of an evaluation challenge to start trading.

Another alternative method is social trading, where traders can copy the trades of successful traders. This can be an excellent way to learn from experienced traders, but it also comes with the risk of blindly following someone else’s trades without understanding the market dynamics.

While the evaluation challenge remains a popular method for evaluating traders, instant funding prop firms and social trading offer alternative methods that may be more effective for some traders. It is important for traders to weigh the benefits and drawbacks of each method before making a decision.

Conclusion

While the evaluation challenge can be a valuable tool for prop trading firms to evaluate potential traders, it comes with significant drawbacks. The challenge can be a daunting and stressful experience for traders, affecting their motivation and confidence. Failing the evaluation challenge can also lead to discouragement and a sense of failure.

It is important to find the right evaluation method for each trader, as different traders have different strengths and weaknesses. Prop trading firms should consider alternative evaluation methods that can better support traders in their development, such as instant funding, which provides traders with real capital to trade with from the start.

Ultimately, the goal of any evaluation method should be to provide traders with the tools and resources they need to succeed. By taking a more supportive and individualized approach to evaluation, prop trading firms can create an environment that empowers traders and enables them to reach their full potential.