Trading Cryptocurrency

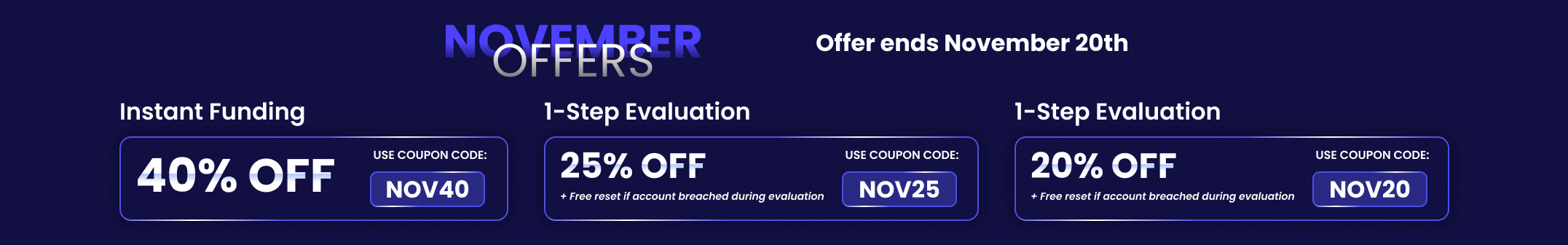

Traders and investors who use FundYourFX are able to trade a wide choice of cryptocurrencies that are now available. If you want to start trading indices, commodities, cryptocurrency, and forex with a leverage of 1:100, you can receive a funded account by applying to be a trader and getting approved for the position. You may get more information by reading our post entitled “Prop Trading For Beginners: Steps To Be a Prop Trader.”

What is cryptocurrency?

One definition of cryptocurrency is “any currency that is created digitally and is protected by cryptography.” In 2009, Satoshi Nakamoto created the first decentralized digital currency. This currency was called bitcoin. By 2013, the value of the currency known as bitcoin had reached the $1,000 level. Since that time, an increasing number of diverse forms of digital currency have emerged.

Bitcoin, Ethereum, Tether, and Ripple are just some of the most well-known cryptocurrencies out of the more than 19,000 that now exist.

Some forms of cryptocurrency can function quite similarly to money when it comes to making purchases. Other cryptocurrencies are treated more like stocks that are traded, which means that the value of these cryptocurrencies might go up and down.

How to trade cryptocurrency?

Cryptocurrency trading, sometimes referred to simply as crypto trading, refers to the practice of speculating on the price fluctuations of cryptocurrencies through the use of a contract for difference (CFD) trading account or buying and selling the underlying coins through an exchange. CFD trading is a sort of derivative that enables investors to speculate on the price movements of underlying assets such as Bitcoin (BTC) without actually owning the assets themselves.

In addition, investors utilize cryptocurrency options as a way to either minimize their risk or enhance their exposure to the market. The term “crypto options trading” refers to the “derivative” financial instrument that obtains its value from the price of another asset, in this instance the underlying cryptocurrency. This value is derived from the price of the cryptocurrency.

List of key cryptocurrencies in FundYourFX

BTC (BTCEUR, BTCUSD)

Bitcoin is a sort of digital currency that functions independently of traditional monetary institutions and governing bodies such as banks and governments. Bitcoin, on the other hand, relies on a decentralized peer-to-peer internet network to validate transactions directly between users.

Bitcoin may be broken into smaller units known as “satoshis” (up to 8 decimal places) and used for payments, but it is also regarded as a store of value, similar to gold. This is due to the fact that since its beginnings, the price of a single bitcoin has significantly increased, going from being worth less than a penny to be worth tens of thousands of dollars. Bitcoin is represented by the ticker sign BTC when it is being discussed in relation to its status as a market asset.

ETH (ETHEUR, ETHUSD)

Ethereum is a decentralized blockchain platform that generates a peer-to-peer network that runs and validates application code in a safe manner. These application contracts are known as smart contracts. Participants are able to transact with each other using smart contracts; thus there is no need for a trusted central authority.

The transaction records are immutable, verifiable, and securely distributed over the network. This enables participants to have complete ownership over the transaction data and full insight into it. Ethereum accounts that have been created by users are responsible for sending and receiving transactions. As a cost for executing transactions on the network, a sender is required to sign transactions and spend Ether, the cryptocurrency that is native to the Ethereum platform.

XRP (XRPUSD)

Ripple was developed by Ripple Labs Inc., a technology company located in the United States. It is a real-time, cryptocurrency gross-settlement system, currency exchange, and remittance network. After that, the business developed its own cryptocurrency known as XRP, which it refers to as a “digital asset made for global payments.”

A cryptocurrency that is powered by the XRP Ledger is known as XRP. You may purchase XRP as an investment, as a cryptocurrency to swap for other cryptocurrencies, or as a means to finance transactions on the Ripple network. All of these uses for XRP are possible.

The Ripple network, which XRP is used on, is fairly centralized and utilizes a consensus protocol: Even while its validation software is available for use by anybody, it also keeps separate node lists that users may choose from to validate their transactions based on which participants they believe are least likely to cheat them out of their money.

ADA (ADAUSD)

Cardano is a blockchain that is decentralized and uses proof-of-stake (PoS), which is supposed to be a more efficient alternative to networks that use proof-of-work (PoW). Cardano’s development is based on a number of fundamental principles, including scalability, interoperability, sustainability, growing costs, energy consumption, and slow transaction times.

The Proof of Stake (PoS) consensus process on the Cardano blockchain makes use of its native coin, ADA. ADA is distributed as a reward to users that contribute to a stake pool and do tasks that benefit the blockchain.

LTC (LTCUSD)

A fork in the Bitcoin blockchain in 2011 resulted in the creation of a new cryptocurrency known as Litecoin (LTC). Its primary purpose was to address the developer’s worries that Bitcoin was becoming too centrally managed and to make it more difficult for large-scale mining organizations to acquire the upper hand in mining. Additionally, it was supposed to make Bitcoin mining more accessible to individual miners.

BCH (BCHUSD)

In August 2017, a fork of Bitcoin led to the creation of a new cryptocurrency known as Bitcoin cash. Bitcoin Cash raised the size of blocks, which enabled an increase in the number of transactions that could be processed and improved the currency’s capacity to scale.

DSH (DSHUSD)

Dash is a cryptocurrency that uses open-source code. It is an altcoin that was derived from the Bitcoin system and then forked. In addition to this, it is a decentralized autonomous organization (DAO) that is managed by a certain subset of its users known as “masternodes.”

What is the disadvantage of trading cryptocurrency?

Although the price of a cryptocurrency has the potential to rise to ridiculous levels, it also has the potential to plummet to frightening lows in the same amount of time. Therefore, if you are seeking an investment that would provide you with consistent returns, you should probably look elsewhere. The cryptocurrency market is driven almost entirely by speculation, and the fact that it is so small means that it is more susceptible to changes in price.

What are the advantages, and why should you trade cryptocurrency?

One thing that all cryptocurrencies have in common is their propensity to undergo abrupt increases (and decreases) in value. The number of coins produced by miners and the demand for those coins from buyers is the primary factors that determine the price. And the interplay of supply and demand can lead to substantial financial gains.

One further benefit that cryptocurrencies have is that the marketplaces for cryptocurrencies are always accessible to buyers and sellers. If you wish to purchase, sell, or trade cryptocurrency, you do not have to wait until the day’s trading session begins in order to do so because coins are created and transactions are recorded around the clock.

In conclusion

Trading cryptocurrencies can be a very lucrative undertaking that results in spectacular earnings, particularly for traders who focus on making short-term trades. You shouldn’t run into any difficulties as long as you have a solid plan for trading crypto on a daily basis. On the other hand, the potential rewards are substantial but the risks are significant.

Now that you are equipped with the knowledge necessary to trade cryptocurrencies, we hope that this will be of use to you when you trade cryptocurrencies with FundYourFX. When you trade cryptocurrency, you have the ability to multiply the value of a trade thanks to our instant funding and leverage of 1:100. This, in turn, can increase the potential profit. However, it is imperative that you do not forget to establish a stop loss before placing the purchase order in order to effectively control your risk. You can learn more about risk management and stop losses by reading our article titled “Mitigate Risk: Stop Loss vs. Stop Limit,” which is available on our blog.