Technical analysis is essential for forecasting future price movements. One of the most recognized and dependable patterns that traders utilize is the Head and Shoulders pattern. Identifying this pattern just before it reaches completion can give traders a significant edge. In this article, we will explore the Head and Shoulders pattern, its importance, and the steps to spot it just prior to completion.

Understanding the Head and Shoulders Pattern

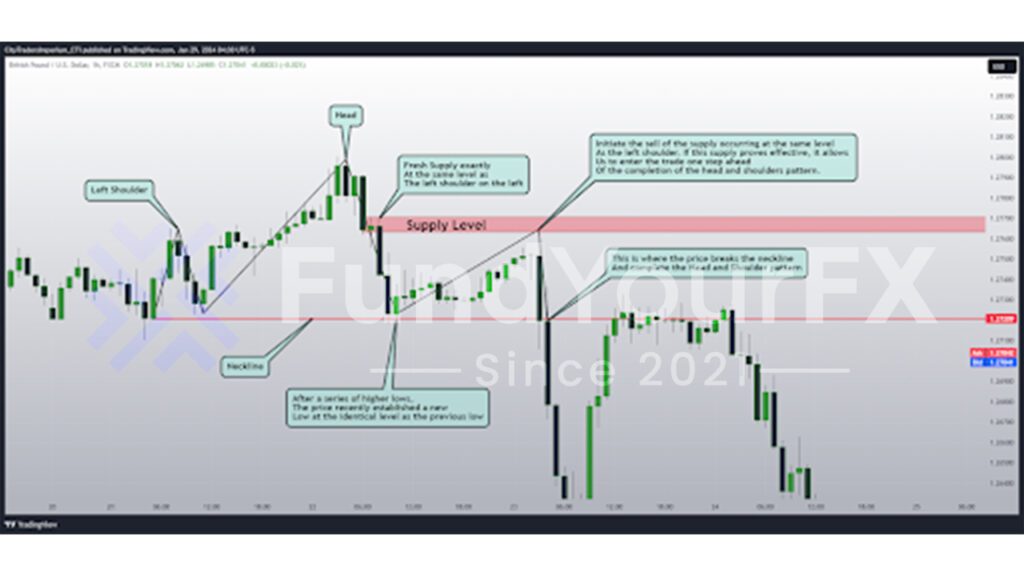

The Head and Shoulders pattern is a reversal pattern that usually appears after an uptrend, indicating a potential shift in the trend towards a downward movement. This pattern is characterized by three peaks: a higher peak known as the head, flanked by two lower peaks referred to as the shoulders.

Key elements of the pattern include the left shoulder, the head, the right shoulder, and a neckline that connects the lows of the two troughs formed between the shoulders and the head. Understanding these components is essential for recognizing the Head and Shoulders pattern in trading.

Downtrend Confirmation:

The Head and Shoulders pattern typically appears after a prolonged uptrend. The first step in recognizing this pattern is to confirm that there has been a prior uptrend. Look for a series of higher highs and higher lows on the price chart, which indicates the prevailing bullish trend.

Formation of Left Shoulder:

The left shoulder is the initial lower peak that forms after the uptrend. Traders should closely monitor the formation of this peak. It’s important to look for signs of hesitation or a slowdown in upward momentum, as these may suggest a potential shift in trend direction.

Formation of Head:

As the price continues to rise after the left shoulder, the head is created, marking the highest peak in the pattern. Pay attention to any signs of overextension or exhaustion in the upward movement. Increased volatility or a decline in buying interest may indicate a possible reversal.

Formation of Right Shoulder:

The right shoulder completes the pattern, forming another lower peak after the head. Similar to the left shoulder, it is crucial to look for signs of weakening bullish momentum. A failure to exceed the height of the head can serve as a significant signal.

Neckline Validation:

The neckline is a horizontal line that connects the lows of the troughs between the shoulders and the head. It is essential to validate the neckline as a critical support level. A breach of this support confirms the completion of the pattern and suggests the onset of a potential downtrend.

Volume Analysis:

Observe the volume during the formation of each peak. Generally, the volume decreases from the left shoulder to the head and then increases from the head to the right shoulder. A noticeable spike in volume during the breakdown of the neckline further validates the pattern.

Key Points to Remember:

- Confirm the prior uptrend through higher highs and higher lows.

- Monitor signs of weakening momentum in the shoulders and head formation.

- Validate the neckline as a critical support level before confirming a downtrend.

Identifying the Pattern Just Before Completion

The head and shoulders pattern is a well-known reversal signal in trading, indicating that the current momentum is likely coming to an end. The concept is simple: imagine a price that is in a bullish trend, consistently forming higher lows. To create the “head” of the pattern, the price must decline significantly, dropping back to the level of the previous low. This decline suggests a potential weakening of buyer strength or an increase in seller dominance.

As traders, we can visualize the head and shoulders pattern developing. The next step is to closely monitor the price movement. If the price begins to rise from the same level as the last low, we should look for a potential entry point. If we notice a clear supply or other compelling factors, we might consider entering a sell position at the level of the left shoulder. This is generally where the price is expected to turn downward if the pattern completes.

By accurately anticipating this movement, we can enter the trade just before the entire pattern is confirmed. This strategy allows us to avoid waiting for the price to break the neckline, providing a significant advantage with a more favorable risk-reward ratio.

To summarize, here are four key points to remember about the head and shoulders pattern:

- It signals a possible trend reversal when the price shows signs of weakening.

- The formation consists of three peaks: left shoulder, head, and right shoulder.

- Entry points can be found at the left shoulder level before the neckline is broken.

- This approach enhances the risk-reward ratio by positioning the trade ahead of confirmation.

The image below illustrates the formation of new supply, allowing us to enter a sell position at the peak of the right shoulder, one step ahead of the pattern’s completion and neckline break.

Conclusion

Identifying the Head and Shoulders pattern just before its completion requires careful analysis of price movements, trend dynamics, and key support levels. By spotting the early signs of a potential trend reversal, traders can strategically position themselves and make informed decisions in the fast-paced world of forex trading.

It’s important to remember to combine technical analysis with other tools and indicators to create a comprehensive trading strategy. This holistic approach can enhance your trading effectiveness and lead to better decision-making in the market.