When trading the Quasimodo pattern in Forex, grasping how it forms and what it indicates about market movements is vital. This pattern typically features three peaks for bearish trades or three troughs for bullish trades, indicating potential reversals in the market. Knowing the right moments to enter and exit trades can significantly influence your overall success in Forex.

Many traders fall into common pitfalls that may lead to financial losses. By addressing these mistakes, you can improve your trading strategies for both bearish and bullish setups. For instance, when identifying bearish trades, watch for the formation of the three peaks, which can signal that the price is likely to drop. On the other hand, in bullish scenarios, the presence of three troughs can suggest that a price increase is on the horizon.

Understanding the Quasimodo Pattern in Forex Trading

The Quasimodo pattern serves as a significant reversal chart pattern in Forex trading. It features three distinct peaks or troughs, which signal potential changes in market trends. Comprehending the layout of this pattern can bolster your trading approach.

For traders, recognizing the Quasimodo pattern allows for better decision-making regarding when to enter or exit trades. By assessing how accurately this pattern predicts market shifts, you can navigate your trading strategies more effectively.

For instance, if you spot a Quasimodo formation, it may suggest that a price reversal is imminent, prompting you to reconsider your current positions.

Understanding these patterns and their implications can greatly improve your trading outcomes. As you refine your skills, keep an eye on how often this pattern appears in various markets and time frames to enhance your trading decisions.

What is The Quasimodo Pattern?

The Quasimodo pattern is a significant chart formation that traders use to identify potential market reversals. This pattern consists of three peaks in bearish scenarios or three troughs in bullish scenarios, indicating possible shifts in market trends.

Its name is inspired by Victor Hugo’s character, reflecting the asymmetrical nature of price movements, similar to a distorted Head & Shoulders formation.

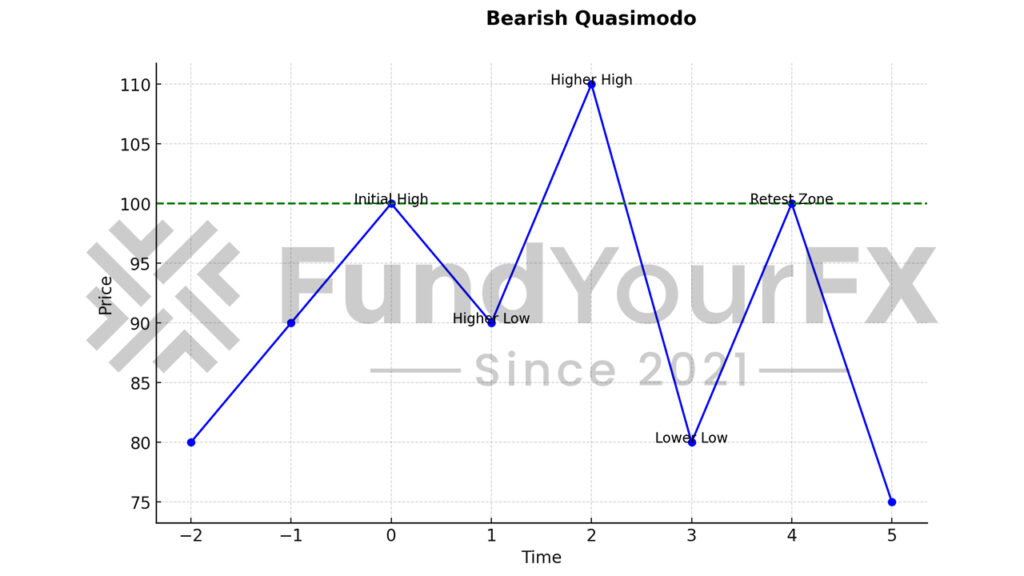

In a bearish Quasimodo pattern, the middle peak stands out as the highest, flanked by two lower peaks. This configuration often hints at an impending downtrend.

On the flip side, a bullish Quasimodo pattern showcases lower troughs, indicating that an upward trend might be on the horizon.

How Accurate is The Quasimodo Pattern?

The accuracy of trading the Quasimodo pattern largely depends on how well a trader can read market sentiment. This pattern illustrates shifts in psychological factors, which can significantly improve predictions for trend reversals. Its effectiveness tends to increase when paired with confirmation indicators, such as moving averages and divergences, which help validate trading signals.

However, traders should exercise caution. The Quasimodo pattern may generate misleading signals, particularly in strong trending markets, making it vital to seek additional confirmations to bolster accuracy.

Historical analysis shows that, when applied correctly, the Quasimodo pattern can lead to favorable risk-reward ratios, often outperforming other reversal patterns. Effective trading requires thorough scrutiny of market conditions, ensuring alignment with larger trends to fully utilize the pattern’s potential.

Trading Strategies for Bearish Quasimodo

When you identify a bearish Quasimodo pattern, it’s vital to take action, as this formation suggests a possible transition from a bullish to a bearish trend.

Initiate a sell position after the formation of the third peak, known as the right shoulder, to take advantage of the forthcoming downtrend. Aim to set your take-profit target at the second trough, which often acts as a significant support level.

To guard against potential false breakouts, position a stop-loss above the head of the pattern. Additionally, validate the bearish signal with tools such as moving averages or divergence indicators.

A definitive break below the neckline increases the trade’s reliability, particularly during a downtrend or periods of high volatility, boosting your chances of a successful outcome.

Trading Strategies for Bullish Quasimodo

To take advantage of a bullish Quasimodo pattern, focus on its formation at the tail end of a downtrend. This pattern consists of three troughs: the middle trough, or head, is the lowest point, flanked by two higher troughs, known as shoulders. Enter a buy position after the second shoulder is established, using the Quasimodo level as your entry point.

Risk Management: Set your stop-loss just below the head to effectively manage risk.

Profit Target: Aim for a take-profit level at the peak located between the head and the right shoulder to ensure a favorable risk-reward ratio.

Confirmation Tools: Use momentum indicators or moving averages to reinforce your trading decision.

Additionally, keeping an eye on market conditions such as volume and volatility can improve the effectiveness of your trading strategy.

Anatomy of the Quasimodo Pattern

The Quasimodo pattern, often referred to as the Over & Under pattern, resembles a distorted Head & Shoulders formation. It is characterized by a series of rising or falling highs and lows, which are interrupted by a change in momentum. This shift hints at a potential reversal in the prevailing trend.

In an Uptrend

- Point A represents the second-to-last peak in the upward trend.

- Point B is identified as the last low before reaching the highest peak, which is higher than the previous low.

- Point C marks the most recent peak, indicating the conclusion of the upward movement.

- Point D introduces a new lower low that disrupts the trend of higher lows. This is known as the Quasimodo level, which signals a potential bearish reversal.

- Point E indicates a pullback to the resistance level at point A, signaling the reversal and serving as the entry point.

In a Downtrend

- Point A: This represents the second-to-last trough in the downward trend.

- Point B: Here, we identify the last high before the lowest trough, which is lower than its predecessor.

- Point C: This is the most recent trough that marks the end of the downward movement.

- Point D: This point indicates a new higher high that breaks the trend of lower highs. Known as the Quasimodo level, it signals a potential bullish reversal.

- Point E: Finally, we see a pullback to the support level at Point A, signaling the reversal and entry point.

How to Trade the Quasimodo Pattern

Successfully trading the Quasimodo pattern demands meticulous identification and accurate execution.

To engage with this pattern effectively, traders must pay close attention to the details and ensure they follow a precise strategy.

Bearish Quasimodo Pattern

- Identify Key Levels: Mark the key points A, B, C, and D.

- Entry Point: Place a sell order near Point C after the price retraces from Point D.

- Stop Loss: Set your stop-loss just above the highest peak at Point C.

- Take Profit: Aim for previous support levels, or utilize a favorable risk-reward ratio.

Bullish Quasimodo Pattern

Identify Key Levels: Mark key points A, B, C, and D.

- Entry Point: Place a buy order near Point C after the price retraces from Point D.

- Stop Loss: Set a stop-loss slightly below the lowest trough at Point C.

- Take Profit: Aim for previous resistance levels or establish a favorable risk-reward ratio.

Advantages of the Quasimodo Pattern:

- Favorable Risk-Reward Ratio: This pattern offers high potential rewards relative to the risk, allowing for tight stop-loss placements.

- Early Reversal Indicator: It provides early signals of trend reversals, allowing for better positioning.

- High Versatility: The Quasimodo pattern is effective in both bullish and bearish market conditions.

- Reliability: It is known for its consistent success rate across various trading scenarios.

Practical Tips for Trading the Quasimodo Pattern:

- Confirm the pattern with support and resistance levels on higher time frames for better accuracy.

- Look for price compression or demand and supply dynamics near Quasimodo levels to refine your entries.

- Utilize Fibonacci retracements for additional confirmation of potential reversal zones.

Common Mistakes to Avoid

Even with a strong grasp of bullish Quasimodo patterns and effective trading strategies, many traders overlook key factors that can significantly influence their success.

One frequent error is jumping into trades without waiting for confirmation signals, which can lead to false breakouts. Letting emotions drive your trading decisions instead of adhering to a well-defined strategy can result in substantial losses.

Additionally, neglecting proper risk management techniques, such as setting appropriate stop-loss levels, can leave you vulnerable to larger-than-expected losses. Ignoring market conditions, like high volatility or low trading volume, might make the Quasimodo pattern less reliable.

Lastly, not reviewing past trades can hinder your ability to refine your approach and improve your performance over time.

As a trader, it’s vital to remain disciplined and analytical. This approach not only helps in navigating market fluctuations but also in building a more robust trading strategy.

Key Takeaways for Successful Trading

Mastering the Quasimodo pattern can significantly improve your trading skills. Begin by recognizing the structure of the pattern, which features three peaks for bearish setups or three troughs for bullish setups. These formations indicate possible market reversals.

To increase the reliability of these patterns, use technical indicators such as moving averages or divergence signals.

Risk Management is Key

Effective risk management is vital in trading. For bearish formations, position your stop-loss orders above the highest peak (the head), while for bullish setups, place them below the lowest trough. This approach helps protect your capital against unexpected market movements.

Strategic Take-Profit Placement

Maximize your profits by setting take-profit levels at significant support or resistance areas, or at critical Fibonacci retracement levels. This strategy ensures that you capitalize on favorable market movements while securing your gains.

Continuous Improvement

Regularly reviewing past trades is essential for refining your trading strategy. By analyzing what worked and what didn’t, you can better adapt to evolving market conditions and enhance your overall trading performance.

In the realm of trading, paying attention to these key aspects will help you navigate the complexities of the market with greater confidence.

Conclusion

Mastering the Quasimodo pattern can significantly improve your Forex trading strategy. This pattern involves recognizing three distinct peaks or troughs, which can help inform your trading decisions. It’s essential to establish your stop-loss and take-profit levels wisely to manage risk effectively. Additionally, consider integrating other indicators to confirm your analysis. Avoid frequent pitfalls that traders encounter and, with practice, you’ll sharpen your skills in capitalizing on these market formations, leading to more reliable outcomes.