Introduction

Staying informed about upcoming economic events is essential for traders to make well-timed decisions. Economic calendars are vital tools that provide real-time updates on key financial events, helping traders anticipate market movements. In this article, we will highlight the best economic calendars that can assist traders in navigating the markets effectively in 2024. These calendars are selected based on their usability, features, and reliability. Let’s dive in and explore the best options available for traders this year.

Best Economic Calendars

1. Forex Factory Calendar

Overview:

Forex Factory is a well-known platform among forex traders, providing a comprehensive economic calendar that tracks major economic events and their potential market impact. The platform is highly regarded for its user-friendly interface and detailed event listings, making it a valuable resource for traders of all levels.

Key Features:

- User-Friendly Interface: Forex Factory’s calendar is easy to navigate, with events clearly listed and color-coded based on their expected impact. This visual clarity helps traders quickly identify important events.

- Comprehensive Event Details: Each listed event comes with detailed information, including the type of event, its previous and forecasted values, and its potential impact on the market. This allows traders to make informed decisions.

- Customizable Filters: Traders can customize the calendar to display events based on their importance, the currencies they affect, and the time zone. This personalization ensures that traders only see the events that matter most to them.

- Historical Data and Charts: Forex Factory provides historical data and charts for past events, enabling traders to analyze how similar events have impacted the market in the past.

Pros:

- Simple and intuitive layout that is easy to navigate.

- Detailed information on each event, including historical data.

- Customizable filters that allow traders to focus on relevant events.

Cons:

- Advertisements on the site can be distracting.

- Limited to forex and related economic events, which might not be suitable for traders focusing on other markets.

Who It’s Best For:

Forex Factory is ideal for traders of all levels who need a reliable and easy-to-use economic calendar. It’s especially useful for those who focus on forex trading and require detailed information and historical analysis of economic events.

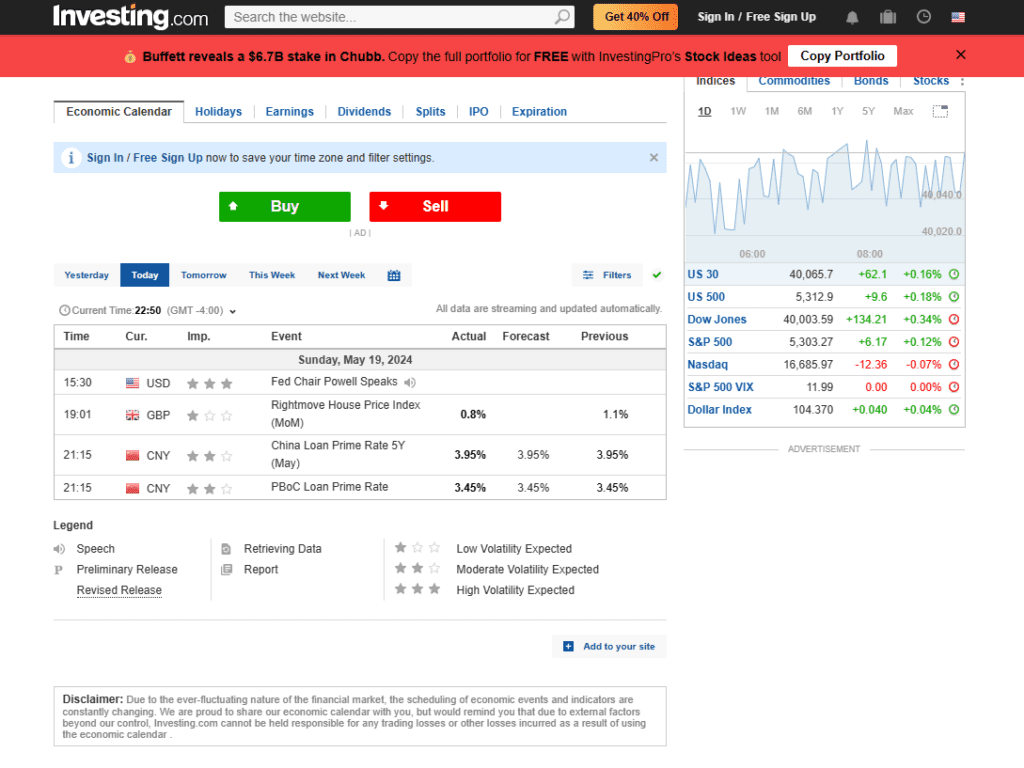

2. Investing.com Economic Calendar

Overview:

Investing.com is a renowned financial platform offering a wide range of tools and resources for traders and investors. Its economic calendar is a standout feature, providing detailed insights into upcoming economic events that can impact various markets.

Key Features:

- Detailed Overview of Events: The calendar covers a broad spectrum of economic events, including central bank meetings, GDP releases, employment data, and more. Each event includes detailed information and analysis.

- Customizable Settings: Users can tailor the calendar to their preferences by filtering events based on country, impact, and time period. This customization allows traders to focus on the most relevant data for their trading strategies.

- Alert Feature: The calendar includes an alert system that notifies traders about specific events. This ensures traders never miss important updates that could affect their trading decisions.

- Real-Time Updates: The calendar is updated in real-time, providing the latest information as soon as it becomes available. This real-time feature is crucial for traders who need to react quickly to market changes.

Pros:

- Extensive customization options allow traders to focus on relevant events.

- Real-time updates ensure timely information.

- The alert system helps traders stay informed about critical events.

Cons:

- The interface can be overwhelming for beginners due to the sheer volume of data.

- Some advanced features may require a premium subscription.

Who It’s Best For:

Investing.com’s economic calendar is ideal for traders who need detailed and customizable economic information. It is especially useful for those who require real-time updates and alerts to stay on top of market-moving events. This calendar is suitable for both forex and multi-asset traders who need comprehensive data to make informed trading decisions.

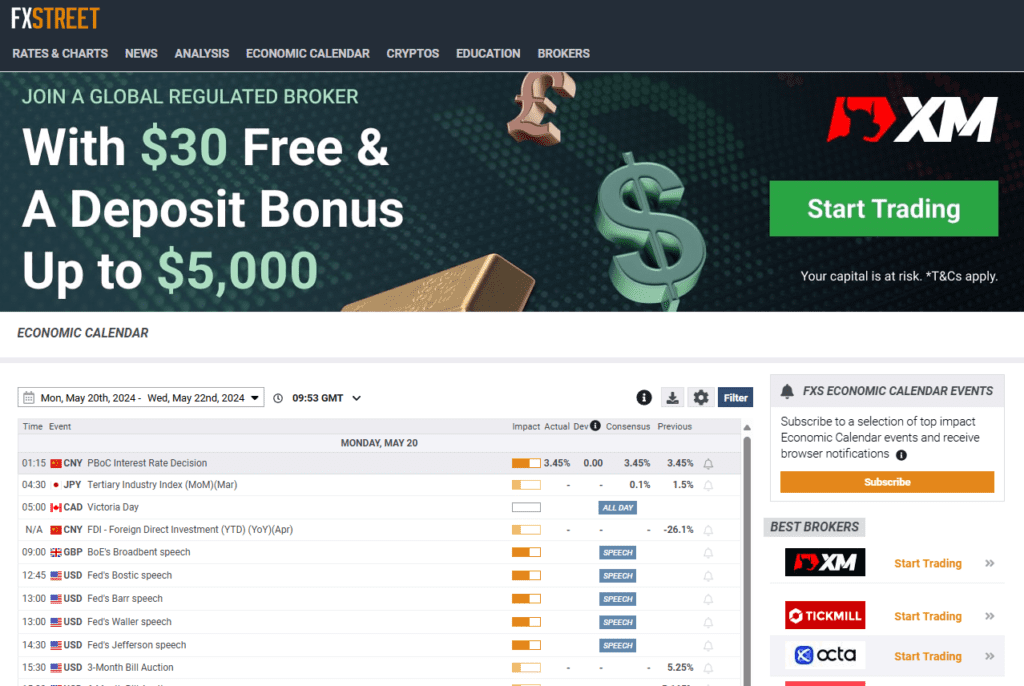

3. FXStreet Economic Calendar

Overview:

FXStreet is a widely respected portal for forex news and market analysis. Its economic calendar is designed to provide traders with comprehensive and timely information on economic events that can influence the markets.

Key Features:

- User-Friendly Interface: FXStreet’s calendar is intuitive and easy to navigate, making it simple for traders to find and understand the events that matter to them.

- Wide Range of Filters: The calendar allows traders to filter events based on their impact, currency pairs, and time period. This helps traders focus on the most relevant information for their trading strategies.

- Market Consensus Data: FXStreet provides consensus forecasts for each event, which helps traders gauge market expectations and potential reactions.

- Mobile App: The calendar is accessible via a mobile app, allowing traders to stay informed while on the go. This is particularly useful for traders who need to monitor economic events in real-time.

Pros:

- Easy to use with a clean and intuitive design.

- Provides market consensus data to help gauge market expectations.

- Mobile app availability ensures access to information anywhere.

Cons:

- Some advanced features may require registration.

- The desktop interface can be cluttered with additional information for new users.

Who It’s Best For:

FXStreet’s economic calendar is ideal for traders who need a reliable source of economic event data and prefer having access to market consensus figures. It is particularly beneficial for those who trade on the go and need a mobile-friendly option.

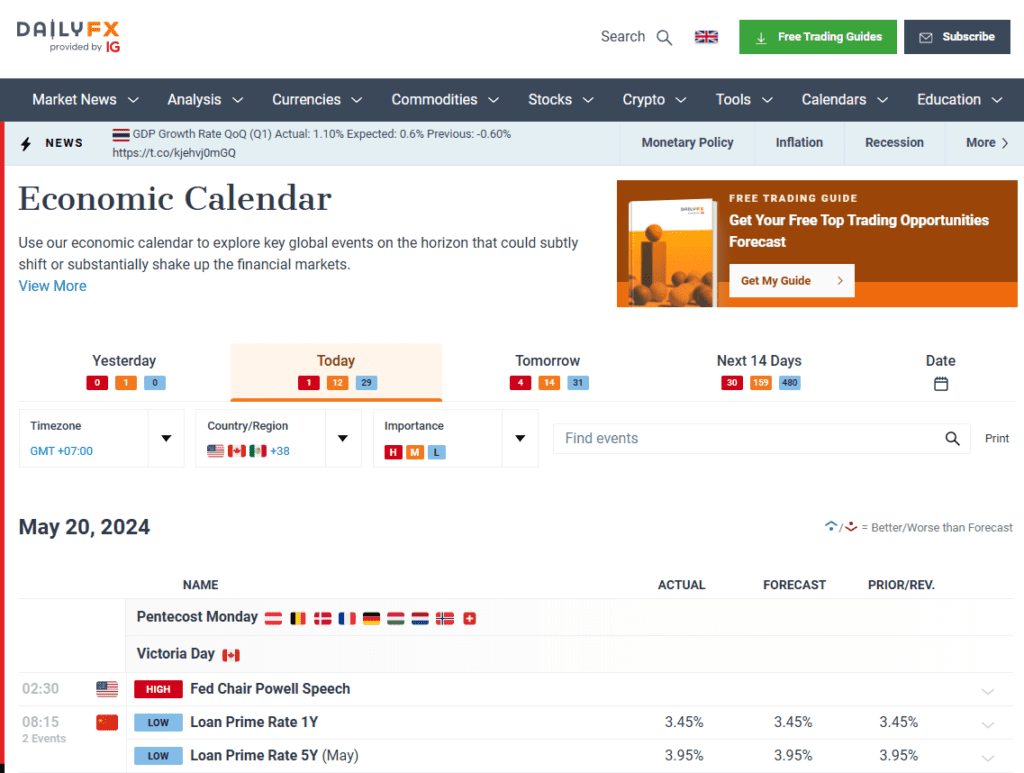

4. DailyFX Economic Calendar

Overview:

DailyFX, part of the IG Group, is a reputable source for forex news and market analysis. Its economic calendar provides traders with comprehensive and up-to-date information on economic events that can impact financial markets.

Key Features:

- Comprehensive Event Listings: The calendar includes a wide range of economic events, such as central bank meetings, GDP releases, employment data, and more. Each event is detailed with its potential market impact.

- Customizable Filters: Traders can customize the calendar to show events based on country, impact level, and time period. This helps in focusing on the most relevant events for their trading strategy.

- Event Reminders: The calendar offers a feature to set reminders for specific events. This ensures that traders do not miss any important updates.

- In-Depth Analysis: DailyFX provides analysis and commentary on major economic events, helping traders understand the potential implications for the markets.

Pros:

- Reliable source with detailed event information.

- Customizable to suit individual trader needs.

- Event reminders help traders stay informed about key events.

Cons:

- Full access to some features requires an IG account.

- The analysis can be overwhelming for beginners.

Who It’s Best For:

DailyFX’s economic calendar is ideal for traders who require detailed information and analysis of economic events. It is particularly useful for those who appreciate additional insights and commentary on how events might affect the markets.

5. Myfxbook Economic Calendar

Overview:

Myfxbook is a popular social trading community and analytical platform for forex traders. Its economic calendar is known for providing a comprehensive view of upcoming economic events and their potential market impact.

Key Features:

- Detailed Event Information: Myfxbook offers extensive details on each economic event, including previous and forecasted values, actual results, and the impact on currency pairs.

- Customizable Filters: Traders can customize the calendar to show events based on their importance, the currencies they affect, and the time zone. This helps traders focus on the most relevant data.

- Alert System: The calendar includes an alert feature that notifies traders about specific events. This ensures traders do not miss important updates that could influence their trading decisions.

- Additional Tools: Myfxbook provides a range of other tools, such as a forex calculator, trading journal, and community features, enhancing the overall trading experience.

Pros:

- Extensive details on economic events.

- Customizable filters to tailor the calendar to individual needs.

- Alerts to keep traders informed of critical events.

- Additional tools to support trading activities.

Cons:

- The interface can be cluttered with various features.

- May require some time to get used to for new users.

Who It’s Best For:

Myfxbook’s economic calendar is ideal for traders who value detailed event information and additional trading tools. It is particularly beneficial for those who engage in social trading and want to leverage community insights.

How to Choose the Right Economic Calendar

Selecting the right economic calendar is crucial for traders who rely on timely and accurate information to make informed decisions. Here are some key factors to consider when choosing an economic calendar:

Ease of Use

- User Interface: The calendar should have a clean, intuitive layout that is easy to navigate. Look for features like color-coded events and clear labels to help you quickly identify important information.

- Customization Options: A good economic calendar allows you to customize the display based on your preferences, such as filtering events by their importance, currency pairs, and time zones. This customization helps you focus on the most relevant events for your trading strategy.

Range of Events Covered

- Comprehensive Coverage: Ensure the calendar covers a wide range of economic events, including central bank meetings, GDP releases, employment data, and other significant indicators. The more comprehensive the coverage, the better equipped you will be to stay informed about market-moving events.

- Timeliness: The calendar should provide real-time updates to ensure you have the latest information as soon as it becomes available. Delayed information can lead to missed opportunities and increased risk.

Additional Features

- Alerts and Notifications: An alert system that notifies you of upcoming events is essential for staying on top of critical updates. Look for calendars that offer customizable alerts to ensure you never miss important events.

- Historical Data: Access to historical data and charts for past events can help you analyze trends and understand the potential impact of similar future events. This feature is particularly useful for developing and refining your trading strategies.

- Analysis and Commentary: Some economic calendars offer additional insights, such as expert analysis and commentary on major events. This can provide valuable context and help you better understand the potential market impact.

User Reviews and Feedback

- Community Insights: Checking user reviews and feedback can provide practical insights into the strengths and weaknesses of different economic calendars. Traders often share their experiences and highlight specific features that are particularly useful or lacking.

- Reputation: Consider the reputation of the platform providing the economic calendar. Established and well-regarded platforms are more likely to offer reliable and accurate information.

Compatibility and Accessibility

- Device Compatibility: Ensure the calendar is accessible on multiple devices, including desktops, tablets, and smartphones. This flexibility allows you to stay informed whether you are at your desk or on the go.

- Integration with Trading Platforms: Some economic calendars can be integrated with popular trading platforms, allowing for seamless access to event data within your trading environment. This integration can enhance your overall trading experience and efficiency.

By considering these factors, you can choose an economic calendar that best meets your trading needs and helps you stay informed about market-moving events. Selecting the right tool will not only improve your decision-making process but also enhance your overall trading strategy.

Benefits of Using Economic Calendars

Economic calendars are invaluable tools for traders, providing numerous benefits that can significantly enhance their trading strategies and decision-making processes. Here are some of the key benefits:

Improved Trading Decisions

Economic calendars provide traders with timely updates on key economic events, allowing them to anticipate market movements and make better-informed decisions. By staying updated on events such as central bank meetings, GDP releases, and employment reports, traders can predict potential market trends and adjust their strategies accordingly. This real-time information is crucial for traders who need to act quickly to take advantage of market opportunities.

Risk Management

Economic calendars play a significant role in managing trading risks. With customizable alerts, traders can receive notifications about important economic events that may cause market volatility. These alerts help traders prepare for potential price swings, allowing them to adjust their positions or set protective stop-loss orders. By being aware of upcoming events, traders can avoid unexpected surprises and make proactive adjustments to their trading strategies to mitigate risks.

Enhanced Market Analysis

Economic calendars offer comprehensive data on various economic indicators, providing traders with valuable insights into market conditions. This data includes historical information and market consensus, which helps traders analyze the potential impact of upcoming events. By integrating this information into their market analysis, traders can develop more robust trading strategies that consider both technical and fundamental factors. This holistic approach to market analysis can lead to more consistent and profitable trading outcomes.

Informed Decision-Making

Traders who use economic calendars are better equipped to understand the context of market movements. The detailed descriptions and analysis provided for each event help traders grasp the significance of different economic indicators and their potential effects on the market. This informed perspective enables traders to make decisions based on a comprehensive understanding of the economic landscape, rather than reacting impulsively to market changes.

Strategic Planning

Economic calendars allow traders to plan their trading activities around key economic events. By knowing the schedule of important announcements, traders can time their trades to capitalize on anticipated market movements. This strategic planning helps traders optimize their entry and exit points, enhancing their overall trading performance. Additionally, by avoiding trading during highly volatile periods, traders can reduce the likelihood of making impulsive and potentially costly decisions.

Economic calendars are essential tools for traders, providing a wealth of information that supports better trading decisions, risk management, market analysis, informed decision-making, and strategic planning. By leveraging these benefits, traders can enhance their overall trading strategies and improve their chances of success in the financial markets.

Conclusion

Economic calendars are indispensable tools for traders, providing critical information that can influence market movements and trading decisions. By utilizing top economic calendars like Forex Factory, Investing.com, FXStreet, DailyFX, and Myfxbook, traders can stay informed about key economic events, manage risks effectively, and enhance their market analysis.

Each of these economic calendars offers unique features, such as real-time updates, customizable filters, alerts, and detailed event analysis, making them valuable resources for traders at all levels. Whether you are a novice trader looking to understand market dynamics or an experienced trader seeking to refine your strategies, these calendars can help you make informed decisions and optimize your trading performance.

Incorporating an economic calendar into your trading routine ensures you are always aware of important economic events and their potential impact on the markets. By staying informed and prepared, you can navigate the financial markets more confidently and increase your chances of trading success. Try out these top economic calendars and find the one that best suits your trading needs and preferences.