Welcome to the Weekly Market Update!

We are here to provide you with the pivotal financial happenings and insights. Our focus is on the primary stories of the week, alongside a deep dive into market dynamics, economic milestones, events to monitor, and technical forecasts. Here’s the essential roundup to keep you savvy and ready for strategic financial moves.

Top Stories of the Week

- US Stock Indices Soar to New Heights: Wall Street’s main indices hit unprecedented highs, driven by optimism for a stable economic future and robust earnings from chipmakers and tech companies.

- TSMC Anticipates Significant Growth: The leading contract chipmaker, TSMC, projects a 25% revenue increase in 2024, fueled by a surge in demand for AI-focused semiconductors.

- ECB Maintains Current Rate: The European Central Bank holds its interest rate steady at a record 4%, tempering expectations for early rate reductions.

- Netflix Shares Surge Following Earnings Report: Netflix’s stock soared by 10% post-earnings, surpassing expectations with 13.1 million new subscribers in Q4, well above the anticipated 8.8 million. Revenues also exceeded forecasts.

- Bank of Japan Signals Potential Policy Shift: The BoJ intimates a possible departure from negative interest rates as early as March, triggering a sharp rise in the yen’s value.

- Microsoft’s Valuation Crosses $3 Trillion: Microsoft joins Apple as the second company to achieve a $3 trillion market capitalization, bolstered by its advancements in AI technology.

- Trump Advances in Presidential Race: Former President Trump secures a victory in the New Hampshire primary, edging closer to the Republican nomination and a potential electoral showdown with President Biden.

- Bank of Canada Holds Steady on Rates: The BoC keeps its interest rate constant at 5% for the fourth consecutive meeting, stating rate cuts will occur only upon assured inflation decline to target levels.

- PBoC Lowers Reserve Rate: In response to the CSI 300’s drop to a 5-year low, the People’s Bank of China reduces the Reserve Requirement Ratio, injecting long-term liquidity to stabilize the market.

- Bitcoin Dips Below $40,000: The prominent cryptocurrency experiences a sharp decline, falling below the critical $40,000 mark, as investors rapidly sell off Grayscale ETF holdings to realize profits.

Market Analysis

- Wall Street Indices Scale New Peaks: The S&P 500 and other key Wall Street indices hit record levels, buoyed by positive US GDP figures. This surge underscores growing investor confidence in the US economy’s resilience, fostering hopes of a ‘soft landing’ amidst lingering concerns over potential recessions and ongoing interest rate debates.

Economic Highlights

- US Economy Exhibits Strong Growth: The US economy outperformed expectations with a notable 3.3% annualized growth in Q4 2023. This unexpected robustness, largely fueled by consumer expenditure, injects a wave of optimism into the market. Contradicting previous recession forecasts, these figures point to a sturdier economic framework, signaling potential stability and resilience in the face of economic challenges.

Upcoming Events to Watch

- Fed Interest Rate Decision (Jan 31): The Federal Reserve is anticipated to maintain its rate at the 22-year apex of 5.25-5.5%. Focus shifts to Jerome Powell’s press conference for indications on potential rate reductions, as December’s inflation rose to 3.8% YoY. The market has adjusted expectations, now foreseeing a less likely rate cut in March but an 85% chance of a 25 basis point decrease by May.

- BoE Interest Rate Decision (Feb 1): The Bank of England is poised to hold its rate at a 15-year high of 5.25%. Despite Governor Andrew Bailey’s stance against early rate cuts, some analysts argue for a softer approach following underwhelming wage and growth data. Market speculation suggests a BoE rate reduction as soon as May, with additional cuts expected in 2024.

- US Non-Farm Payrolls (Feb 2): The upcoming US non-farm payroll report, following closely after the Fed’s rate decision, may draw less attention. December’s report exceeded expectations with 216K jobs added, keeping unemployment at 3.7%. Market participants will scrutinize this data for further evidence of labor market strength, with potential weakness influencing anticipations of earlier Fed rate cuts.

- Eurozone CPI Release (Feb 1): Eurozone’s CPI, which climbed to 2.9% YoY in December, will be under the microscope. The focus is on whether inflation will align with the ECB’s 2% target, potentially swaying central bank policy. However, escalating supply chain issues and shipping disruptions could sustain inflationary pressures.

- Big Tech Earnings Reports: Following Tesla and Netflix’s divergent earnings outcomes, attention turns to other tech giants. Microsoft and Alphabet are set to report on January 30, while Amazon, Meta, and Apple are scheduled for February 1. With the NASDAQ100 at record levels, market expectations are high, seeking robust fundamentals to justify current valuations.

Technical Analysis

We have analyzed the most popular trading pairs and assets, including EUR/USD, GBP/USD, Gold, and US500. Our aim is to provide you with an insightful analysis of their trends and support/resistance levels, which will help you make informed decisions.

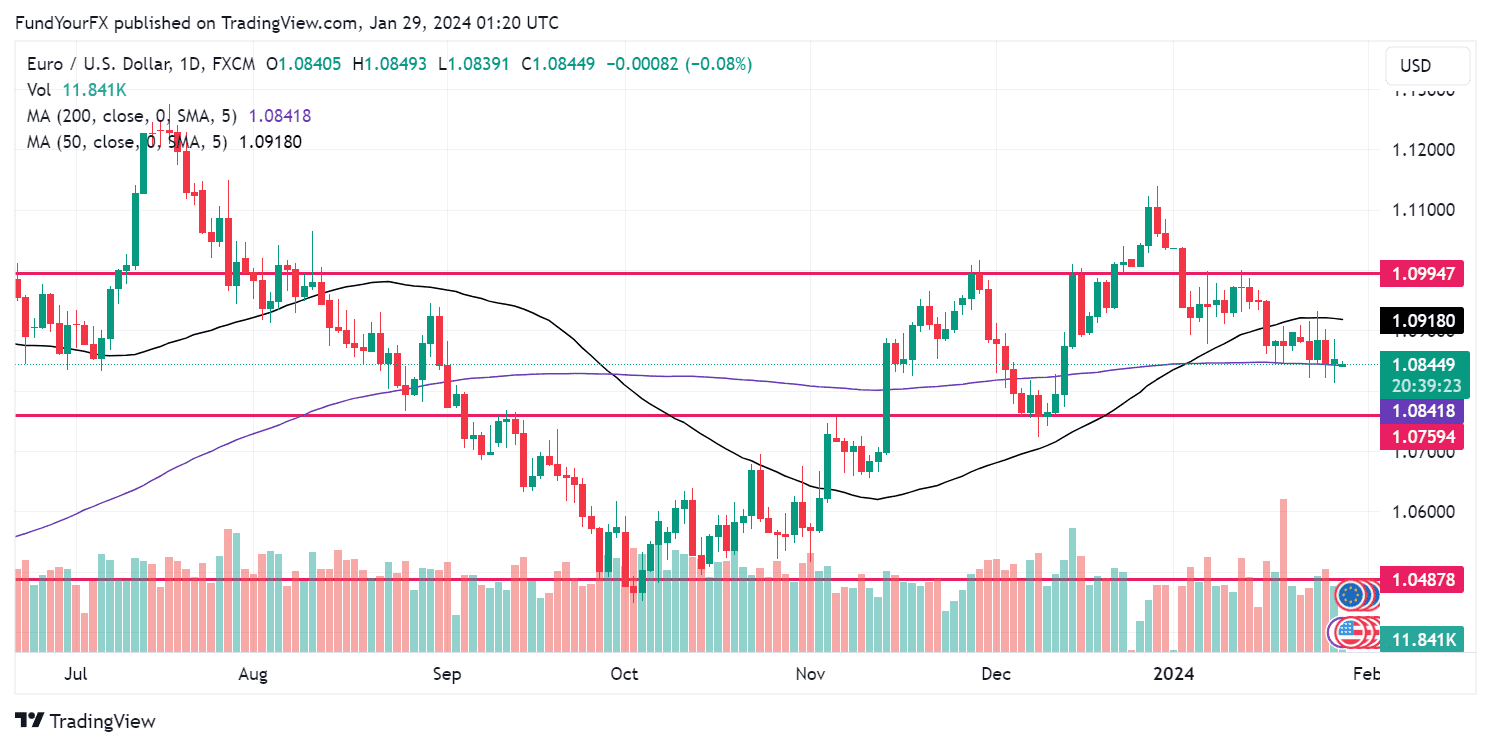

EUR/USD

EUR/USD is currently experiencing a pullback, having dropped below the 50-day Simple Moving Average (SMA), which puts the ongoing bullish trend at risk of reversing. The pair has established support at 1.06947 and 1.05024, while facing resistance at 1.0892 and 1.10958. The Relative Strength Index (RSI) at 46 suggests a neutral to slightly bearish market sentiment. It’s anticipated that the price will stabilize within the current support range before completing its correction and resuming the uptrend.

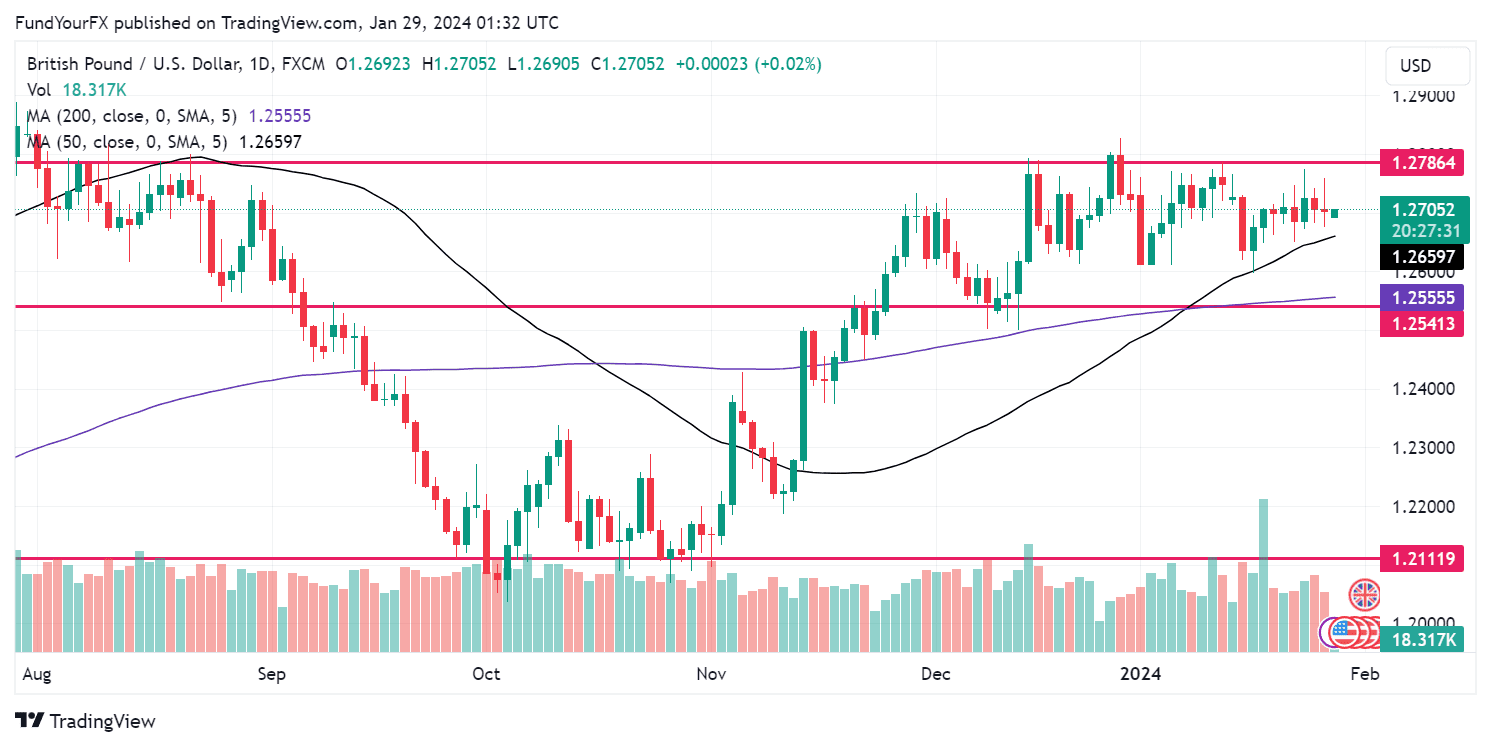

GBP/USD

GBP/USD is in a bullish trend, staying above a rising 50-day Simple Moving Average (SMA). The pair is in a consolidation phase, with fractals indicating equal highs and lows. Key support levels are at 1.2633 and 1.2378, while the nearest resistance is at 1.2895. The Relative Strength Index (RSI) at 54 suggests a neutral momentum with a slight bullish inclination. The British pound is currently outperforming most G10 currencies, including the US dollar, driven by market expectations that the Bank of England (BoE) will adopt a more cautious approach compared to the Federal Reserve and the European Central Bank (ECB).

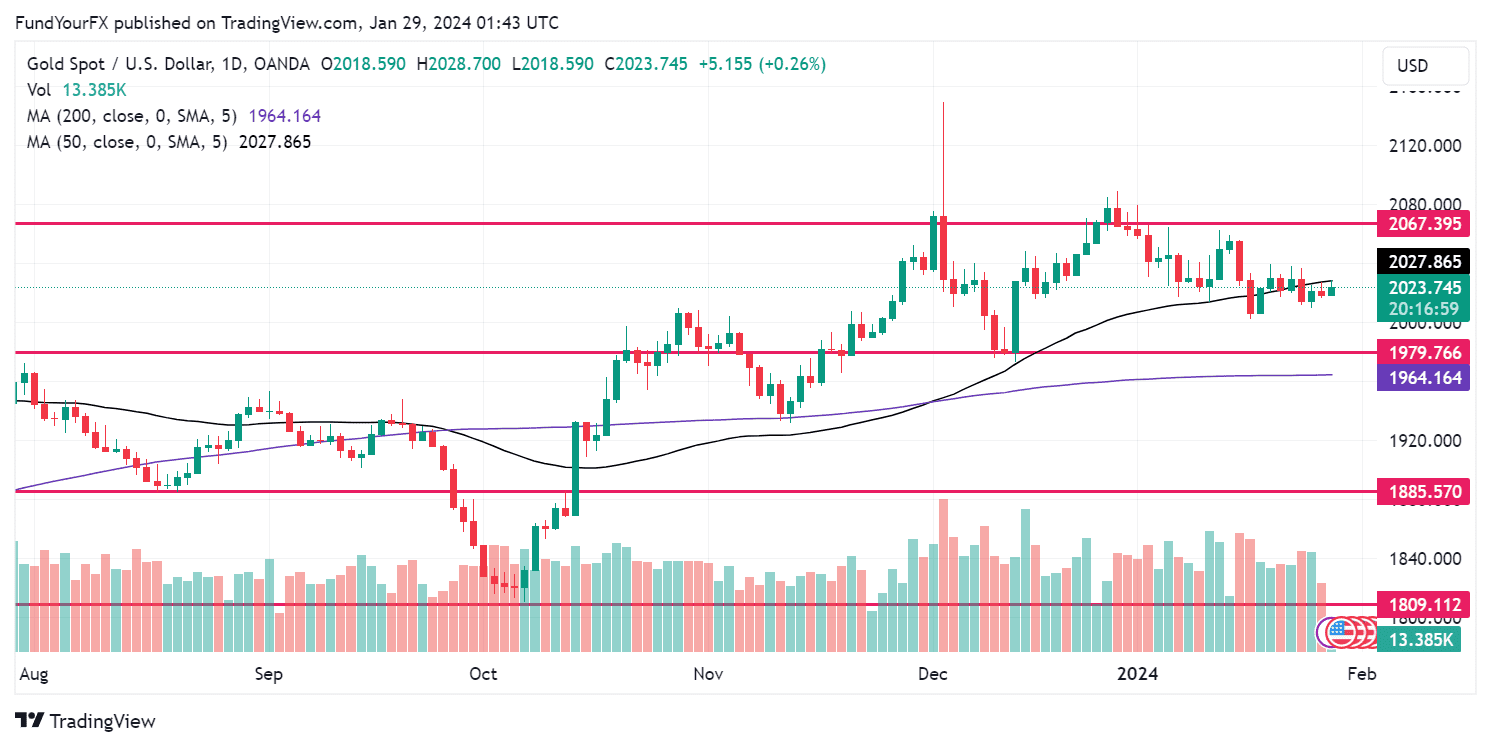

XAU/USD

Gold (XAU/USD) is currently displaying a neutral trend, oscillating around the 50-day Simple Moving Average (SMA) in a consolidation phase. Key support levels for gold are identified at 1971.0 and 1904.7, with resistance points at 2023.3 and 2104.0. Recently, gold broke its 1-day trendline and completed a retest. If the price remains below 1940, it suggests a bearish outlook. The Relative Strength Index (RSI) at 45 reflects a neutral market momentum, indicating a state of uncertainty in the market.

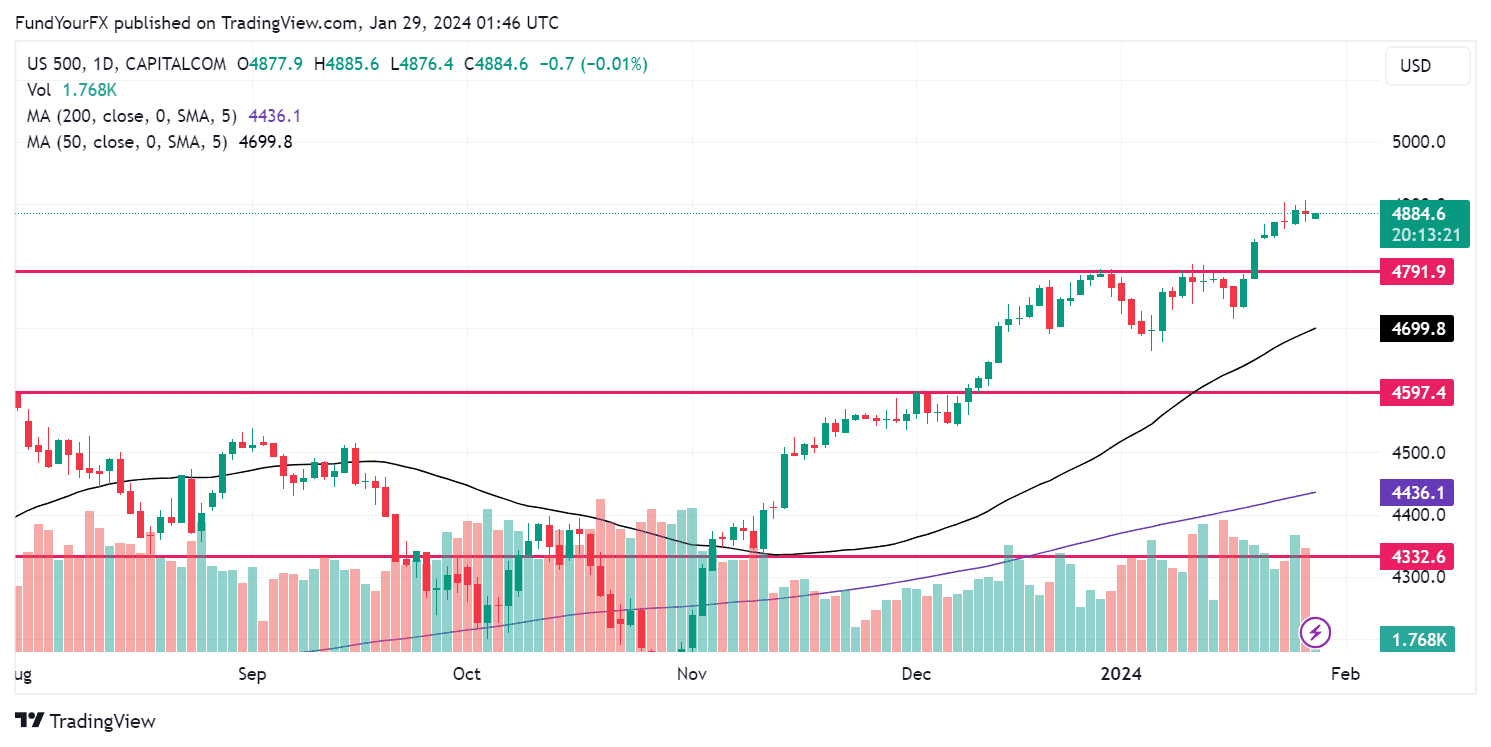

XUS500

The S&P 500 Index is exhibiting a robust bullish trend, recently hitting a new all-time high. Currently, it’s in a correction phase, approaching the 4880 support and resistance zone. Key support levels are at 4759 and 4590, with an immediate resistance point at 4900. The Relative Strength Index (RSI) is high at 70, indicating overbought conditions. However, in strong market trends like this, the index can sustain these overbought levels while continuing to rise.

Thank you for reading! Wishing you successful trades ahead!

Unlock your trading potential with FundYourFX, the award-winning instant funding prop firm. Experience real funding from day one, flexible trading rules, and profit share of up to 70%. Visit FundYourFX now and start achieving your trading goals today!